Ethereum, the second largest cryptocurrency and the decentralized finance colossus, has experienced exponential growth, prompted by various crypto events, DeFi, and NFTs. However, the network’s massive adoption has led to stress on the infrastructure. Network congestion, low speed, and high gas fees are weighing on Ethereum.

Many projects that use Layer 2 scaling protocols tackle these issues to boost the network’s performance. zkSync is one of these, and it brings scalability without sacrificing security. Even though ETH 2.0 will offer many improvements, there is no consensus on when it will go live.

Until then, solutions such as zkSync will continue to gain momentum, providing many benefits.

I. What Is zkSync?

Created by Matter Labs in December 2019, the team is committed to solving Ethereum’s problem with rollup. While much attention is centered on improving users’ and developers’ experience, zkSync explores the best strategies to make zkSync a fascinating project on Ethereum for both end-users and developers.

zkSync is a layer 2 trustless protocol offering scalable, low-cost payments on Ethereum, fueled by zkRollup technology. The project implements zero knowledge tech to ensure the full security of users’ funds while optimizing scalability, transparency, and other features of the main chain.

zkSync is a Layer 2 scaling solution that offers cheaper and faster transactions than the main Ethereum blockchain (Layer 1). Layer 2 solutions move most activity away from Layer 1, while still inheriting its security and finality.

With zkSync 2.0 and upcoming sharding, it may handle more than 100,000 transactions per second (TPS). Furthermore, zkSync 2.0 will also offer arbitrary smart contract capabilities via its compatibility with Solidity (zkEVM), the rollup’s internal programming language, Zinc.

II. How Does zkSync Work?

The concept of zkSync is to provide a trustless and zero-compromise Layer 2 scaling solution for the Ethereum blockchain. The outcome is how users can send funds over zkSync without worrying over switching between layers, new deposit addresses, or friction.

Moreover, the zkSync solution is exciting for both users and developers. The prospect of lower fees, enhancing the UX aspect of crypto wallets and services, and the various DeFi enhancements to explore are just some examples of why this project matters. It removes the need for third parties, instant confirmations, up to 99% fee reduction, and ensures payments can occur to existing Ethereum addresses and smart contracts alike.

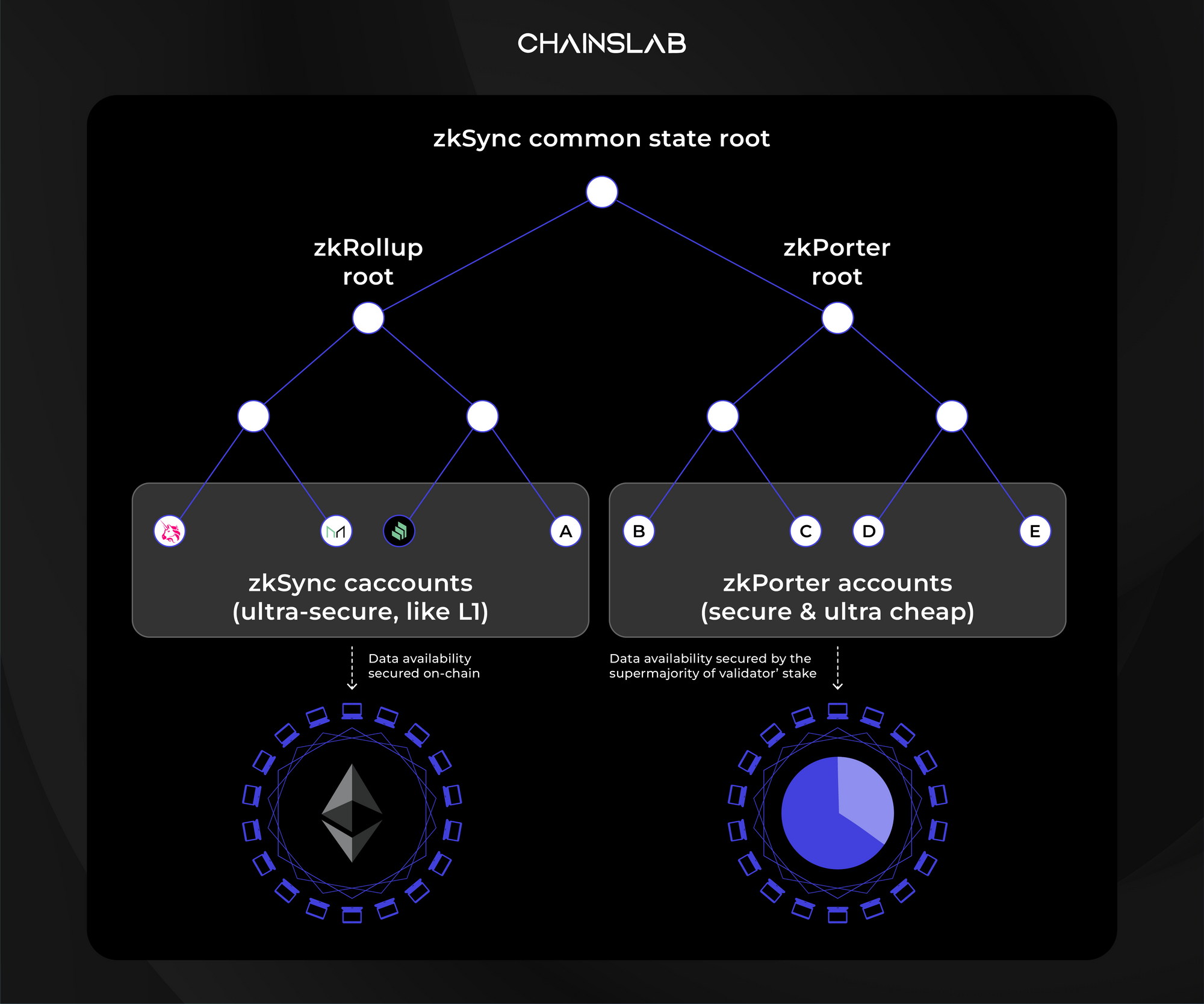

zkSync is an L2 protocol structured on ZK Rollup. It uses zero knowledge proofs and on-chain data availability to ensure seamless transfer of assets between L1 and L2. To fully understand this, you’ll need to know what rollups are.

There are, however, two different rollups currently used on Ethereum: ZK rollups and Optimistic rollups. In ZK rollups ('ZK' standing for zero-knowledge) the batch of transactions is verified for correctness on the Ethereum network. After the verification passes, the batch of transactions is considered final like any other Ethereum transaction.

This is achieved through the power of cryptographic validity proofs (commonly called zero-knowledge proofs). With any batch of off-chain transactions, the ZK rollup operator generates a proof of validity for this batch. Once the proof is generated, it is submitted to Ethereum to make the roll-up batch final. In zkSync, this is done via a SNARK, succinct non-interactive argument of knowledge.

III. zk-Rollups vs. Optimistic Rollups

Optimistic rollups like Arbitrum and Optimism utilize the optimistic approach to secure their network. At the time of their development, they represented an important incremental improvement over other available options. However, a widely held opinion including Vitalik Buterin, is that optimistic methods represent yet another temporary solution and in the long run the only permanent and truly scalable solution will be blockchains based on Zero-Knowledge proofs.

Optimistic rollups suffer from the following key issues:

- Optimistic rollups are secured via game theory. This method assumes all transactions are valid and then utilizes an after-the-fact game theory mechanism to pay participants to discover fraudulent or otherwise invalid (e.g. because of bugs) transactions. Game theory is never perfect and as with the game theory that broke with stablecoins and other systems, the author just doesn't think it can be relied on in the long term and at true scale to offer the security the ecosystem needs.

On the other hand, zkSync 2.0 relies on math, not game theory, to provide the absolute certainty of proof that every single transaction is provably valid and not fraudulent.

- Optimistic methods take days to settle. Settlement time is becoming an increasingly important feature for ecosystem partners. As ecosystem partners’ needs mature, the need for as close to instant settlement will rise. With optimistic methods, this settlement problem will not go away. It's always going to be a 7-day settlement time because optimistic methods need 7 days for their after-the-fact game theory to conclude its challenge window. The only way around this is to bring in third parties that provide some liquidity, but then again this is a potential security risk in trusting the liquidity providers.

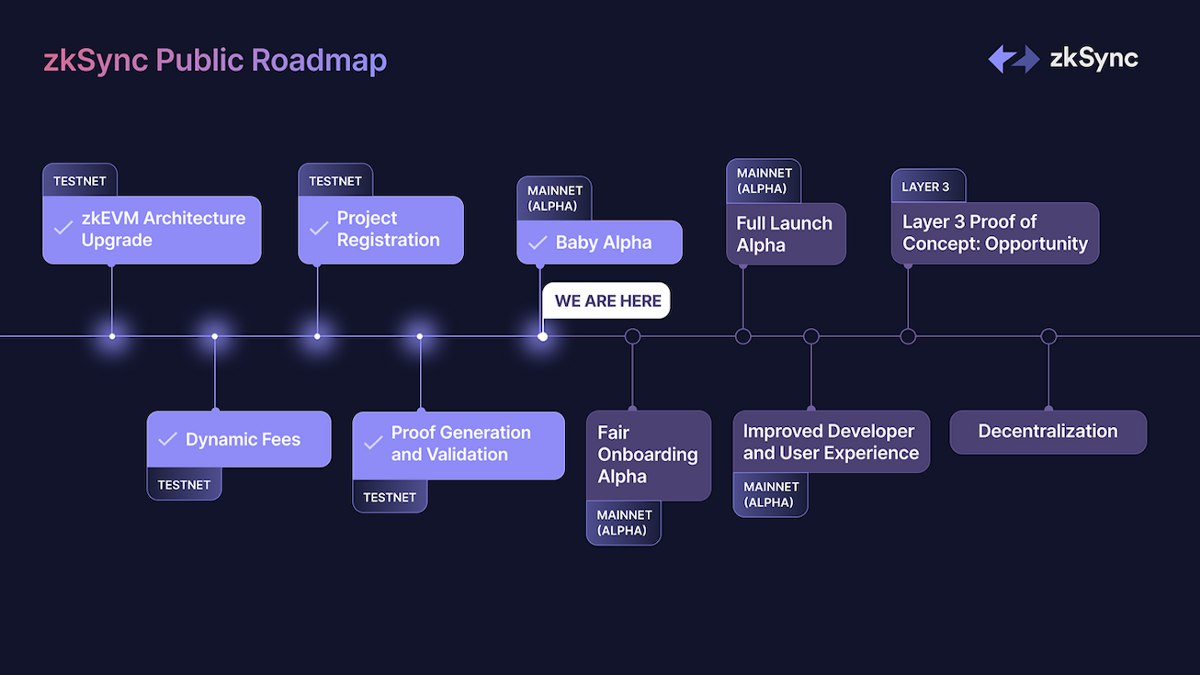

When zkSync 2.0 initially launches on Mainnet, it will provide settlement in hours but the network is targeting settlement within minutes after months of work and will improve settlement times to near zero - no partner needs to change any code.

- Optimistic rollups have no method of scaling beyond where they are now. When optimistic methods first came out, they became popular because they scaled Ethereum up (e.g. they enabled the processing of 10x Ethereum transactions without degradation of security and decentralization). The problem is that while they can scale Ethereum by 10x now, they have no mechanism to go beyond 10x without degrading security and decentralization.

In contrast, zkSync 2.0 is based on zero-knowledge proofs which have important characteristics that optimistic methods do not. They can hyperscale.

IV. The Future Of zkSync

By significantly reducing gas costs without sacrificing security or user control, zkSync seems like the best choice when it comes to Layer 2 Ethereum scaling solutions. With zkSync 2.0 in the pipeline alongside other future upgrades, the sky’s certainly the limit when it comes to achieving Matter Labs’ mission of VISA-scale throughput of thousands of transactions per second.

The team aims to attain this without compromising on the underlying security of Layer 1 accounts.

When it comes to decentralization goals, zkSync is currently fully noncustodial with zero trust assumptions. This means zkSync validators have no power to interact with users’ assets without explicit authorization. As the team is committed to developing zkSync into a fully decentralized protocol, current users are likely ahead of the curve, as Matter Labs has yet to introduce validators and guardians into the mix.

V. zkSync Team & Investors

ZKSync is founded by Matter Labs, a German-based company working on scaling Ethereum. Co-Founder & CEO Matter Labs, Alex Gluchowski and his team began working on the zkSync solution in December 2019 and released its zkSync v1.0 in June 2020. This first iteration was able to scale to 300 transactions per second.

The development of zkSync 2.0 saw the release of the alpha version of zkEVM, which enabled the compatibility of Ethereum Virtual Machine (EVM) in the rollup environment. Furthermore, with the development of zkPorter, a sharding solution, zkSync is working on increasing throughput from 3,000 tps (in its 1.1 version) to 20,000 tps.

Matter Labs raised $2 million in a seed round in September 2019 and another $6 million in a Series A round in February 2021 from crypto companies like Binance, Aave, Curve and Coinbase Ventures. Its Series B raise in November 2021 saw another $50 million raised from venture capital funds like a16z, Dragonfly, and Placeholder. In January 2022, the company was backed with another $200 million by BitDAO.

The latest Series C round has closed with another $200 million co-led by Blockchain Capital and Dragonfly Capital. It brings the total funding for zkSync to $458 million.

VI. The Bottom Line

By focusing on becoming the defacto Layer 2 solution for Ethereum, zkSync certainly has plenty of potential to achieve its grand mission of successfully addressing scaling issues, while maintaining mainnet levels of security, the privacy of its users, and full decentralization as a platform.

Additionally, many scalability solutions are still in development, typically the two models that are about to be introduced to the network, zkEVM and sharding. It is certain that no one will be able to criticize the Ethereum for being slow and not efficiency network.

With the V2 launched and a potential native token, zkSync is expected to gain even more traction than it did until now. Yet, it already has some interesting backers and the funds coming from the fundraising rounds are increasingly bigger, showing that the project is moving forwards, which is great for Ethereum as it can benefit from layer-2 technologies such as the one offered by zkSync. Scalability, fees or security could all benefit from greater adoption of this technology.

Official Links

Website: https://zksync.io/

Twitter: https://twitter.com/zksync

Discord: https://discord.com/invite/px2aR7w

Telegram: https://t.me/zksync