I. Introduction

All innovations stem from underlying problems, just like what Bitcoin does. Decentralized finance (DeFi) was created to tackle the issues inherent in traditional finance systems, which is centralization, lack of transparency, lack of seamlessness, inefficiencies, and unjust interference by powerful entities. While DeFi primarily focuses on enhancing transparency, self-custody, scalability and decentralization, it is worth noting that being a relatively nascent concept, DeFi encounters various obstacles that limit accessibility for ordinary users or masses.

Scalability and high transaction fees hinder the smooth functioning of DeFi applications. The complex user experience (UX) and technical requirements pose obstacles for mainstream adoption. Addressing these challenges is crucial for the widespread acceptance and success of DeFi. As a consequence, centralized entities emerged to bridge the gap between DeFi and the traditional realm. These entities, known as centralized exchanges (CEXs) and other centralized finance (CeFi) firms, serve as the primary gateway for most users, both retailers and institutions, often being the sole platform for their transactions and investments.

Conceptually, these centralized platforms may seem relatively no wrong. However, beneath the surface, these entities exhibit the most significant shortcomings. There is a saying in crypto, “Not your key, not your coins”, it means custodial. You forfeit control over your assets while users are left powerless as the platform technically holds custody of their assets.

You must not forget the series of events in 2022, the contagion of the FTX (the second largest crypto exchange at that time) and the collapse of CeFi firms like 3AC, Celsius vividly demonstrate the severe mismanagement occurring within these opaque entities. When these companies become insolvent, users are left with the sudden and complete loss of everything, with limited recourse available to them.

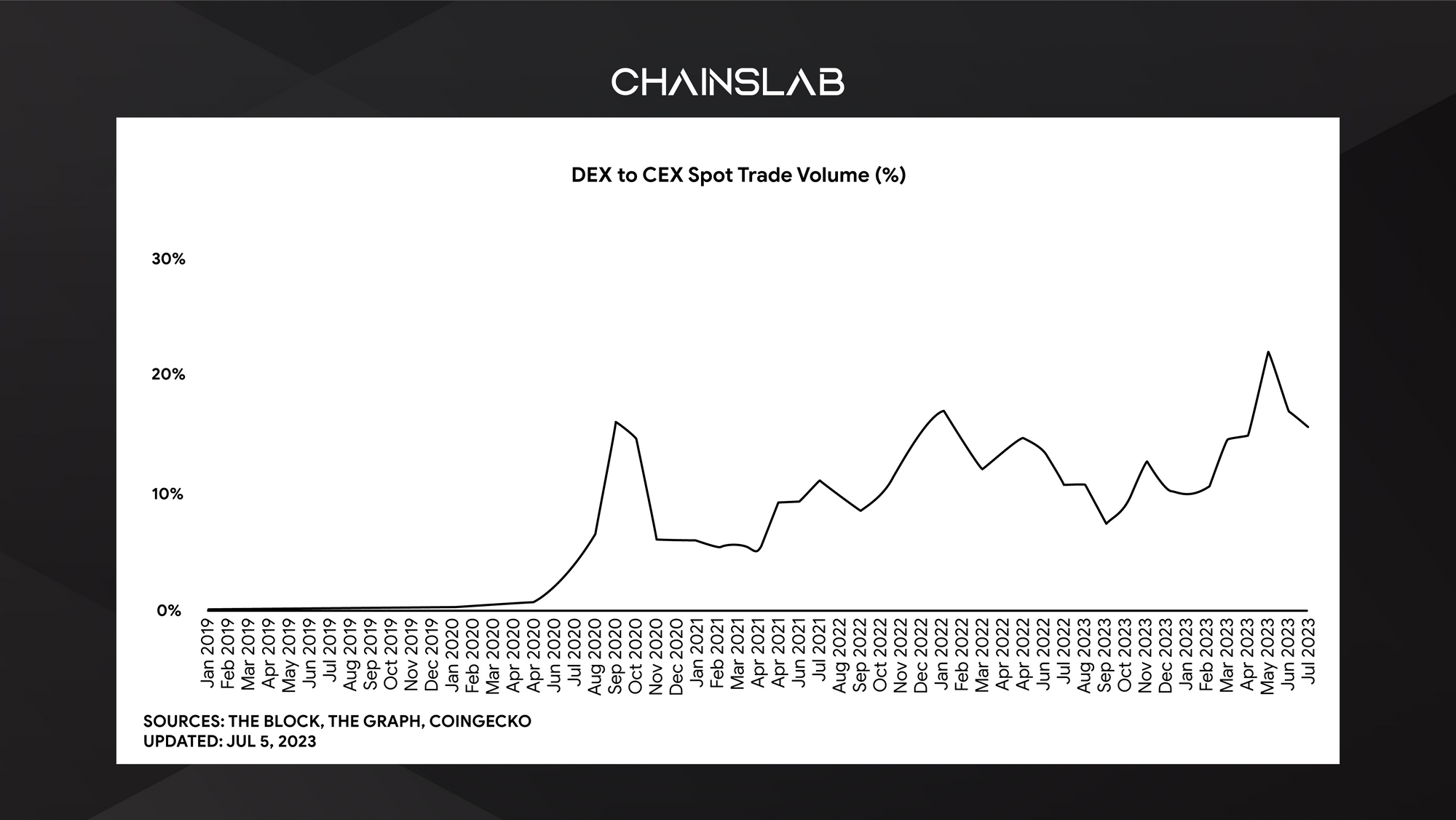

Since then, the market has seen a large number of users begin to get exposed to the concept of DeFi, for their fund safety. The FTX crisis brought investors to decentralized exchanges (DEXs), and DEXs gained market share as faith in centralized crypto players eroded where users have more control over their assets. The ethos of the crypto sector has been to empower users to use decentralized technology to protect themselves from the actions of risk-seeking intermediaries. DEXs have been the safe haven crypto move. In results, a lot of good DEXs like dYdX, GMX, Perp, etc. grab this transition.

But the latest window of opportunity for the DEX won’t stay wide open for long. DEXs garner significant attention when CEXs go bust. At present, DEXs still cannot match the liquidity and financial strength of their centralized counterparts. In the author's opinion, decentralized exchanges are not ready for high-frequency trading, or algorithmic trading as its counterparties offer. It still has problems with the depth of the order book, and execution speed. And in many pairs, there are no market makers who can fill an order book. And the goal is to take the best from DEX - the storage approach, and the best from CEX - speed of operation and the depth of liquidity. Combining the best tools in one product will lead to a breakthrough.

This article aims to deliver that vision of a vertically integrated exchange that can marry DeFi’s obvious security benefits with the performance and convenience necessary to rival any CEX - Vertex Protocol.

II. What is Vertex Protocol?

Since launch on Arbitrum in April, the protocol has accumulated over $1 billion of volume across spot and perpetuals trading, making it one of the fastest-growing trading platforms in the market. As mentioned, Vertex aims to be a DEX that can provide everything users need to trade effectively without any of the compromises presented by centralized competitors. As stated in their documentation, Vertex is a decentralized exchange protocol that operates on the cross-margining principles. It provides users with access to spot trading, perpetual contracts with a hybrid trading mechanism between central limit order book (CLOB) and automated market maker (AMM), and a built-in money market to allow users lending and borrowing for yield, all seamlessly integrated into a single comprehensive application that is currently active on the Arbitrum network. Users don’t have to access multiple platforms, instead of heading to Aave to lend and borrow, to Uniswap to trade spot, to GMX for perpetual trading, now Vertex is all you need.

One unified source of liquidity for traders everywhere. Vertex is recognized for its hybrid Orderbook-AMM approach, which addresses the constraints of both DEXs and CEXs, offering a solution that mitigates their respective limitations. Have you tried trading on Vertex? It’s interesting that the processing speed is respectively instant, just in a blink. The protocol conducts trades with speeds of 10-30 milliseconds from its lightning-fast order book matching engine. Now you would ask yourself how they could do that, even Arbitrum is not that speed.

Vertex’s design principles can be categorized into three fundamental pillars:

- A fully on-chain trading platform utilizes a constant product AMM

- A fully on-chain risk engine

- An off-chain sequencer handles order matching

Vertex’s fundamental operates as a completely on-chain trading platform, utilizing a constant product AMM mechanism. On top of this, there exists an off-chain order book, referred to as the “sequencer”. By default, Vertex employs the on-chain AMM for trade execution, complemented by the presence of an off-chain sequencer.

In essence, Vertex provides the best of both worlds by offering the performance and features comparable to popular CEXs, while still harnessing the inherent advantages of on-chain mechanism in the realm of DeFi. This enables users to enjoy the benefits of AMM and off-chain order book, while effectively minimizing the limitations typically associated with such systems. For more understanding about the sequencer’s mechanism of action, we will give a more detailed analysis in another article. Stay tuned!

III. Vertex vs Others

Vertex offers the lowest fees among its competitors, with fee-free trading for makers. Taker fees for core markets are just 0.03% for spot and 0.02% for perpetual contracts. Even in other markets, fees still are only slightly higher. Vertex’s competitive fees are expected to attract advanced traders and capital over time.

To our knowledge, Vertex is the first crypto exchange to offer such exceptional capital efficiency. Unrealized profit and loss from perpetual trades can be automatically utilized as collateral for leveraged spot positions and vice versa. In addition to universal cross-margin, Vertex allows an unlimited number of sub-accounts for isolated margin trading, surpassing that of 10 on Binance.

With its off-chain order book, Vertex provides exceptionally fast trade executions in fractions of a second. The trades are executed in a first come - first serve manner, ensuring efficient and fair order processing. Compared to the trading mechanism of GMX, Vertex doesn't seem to be appeased by the "zero-price impact" trade on GMX. GMX was built on the GLP model based on the theory of traders always losing, in return, stakeholders always earn real yields that are losses of other traders. As shared in this article reviewing GMX, despite initial hype surrounding the novel concept of Real Yield, several projects attempted to adopt this mechanism. However, the author remained skeptical about its effectiveness of GMX. Let’s imagine a scenario once we enter a highly bullish market, much like the one witnessed in 2020-2021. Even in such a market, the author observed that numerous exchanges, despite experiencing substantial trading volumes, were still compelled to shut down due to the exhaustion of their liquidity-owned pools.

Moreover, Vertex’s design offers complete protection against the manipulation of transaction ordering known as Miner Extractable Value (MEV). Without this, other exchange users, i.e dYdX, are in exposure of frontrunning, consistently losing, higher fees, yes, it hurts traders so hard over and over.

Deep liquidity, low fees, no MEV and high throughput would be a go-to-venue for retail and institutional traders alike.

IV. Vertex Tokenomics

Tokenomics

The VRTX is the governance token of the Vertex Protocol, intended to enable decentralized governance by stakeholders in the DAO. Within its tokenomics, VRTX can be converted into two different subtypes, each serving specific purposes:

- xVRTX: acquired by staking VRTX. These holders will get benefits in governing, and revenue sharing and token emission of the protocol.

- voVRTX: acquired by staking xVRTX in Insurance Staking Pools. These holders will get more rewards, more voting power and a discount on protocol fees, and won’t be able to transfer.

It can be said that the economic design emphasizes the rights of token holders, incentivizing them to keep longer with DAO voting mechanisms and distributing a part of revenues. Thereby creating a sustainable and real yield.

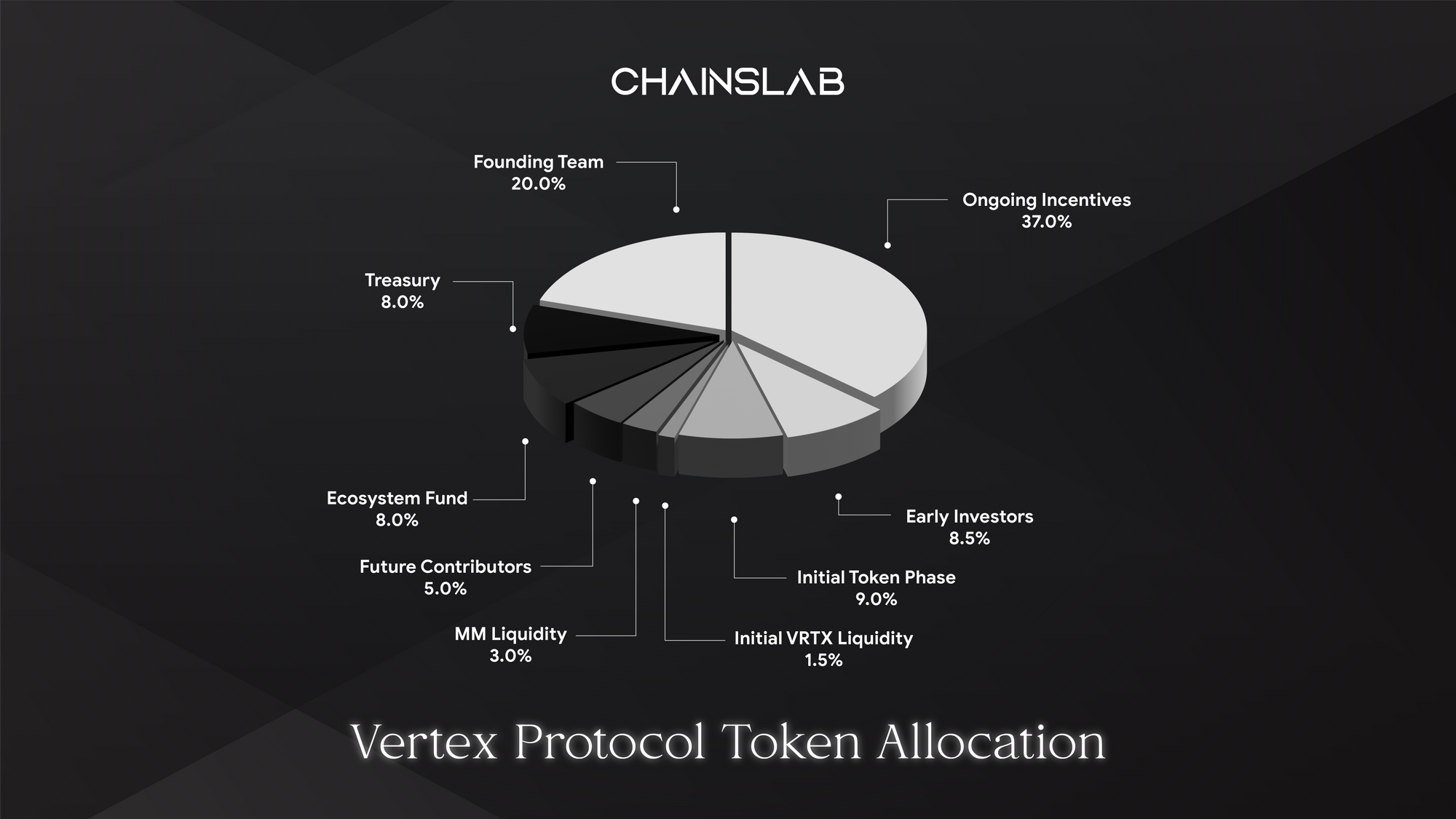

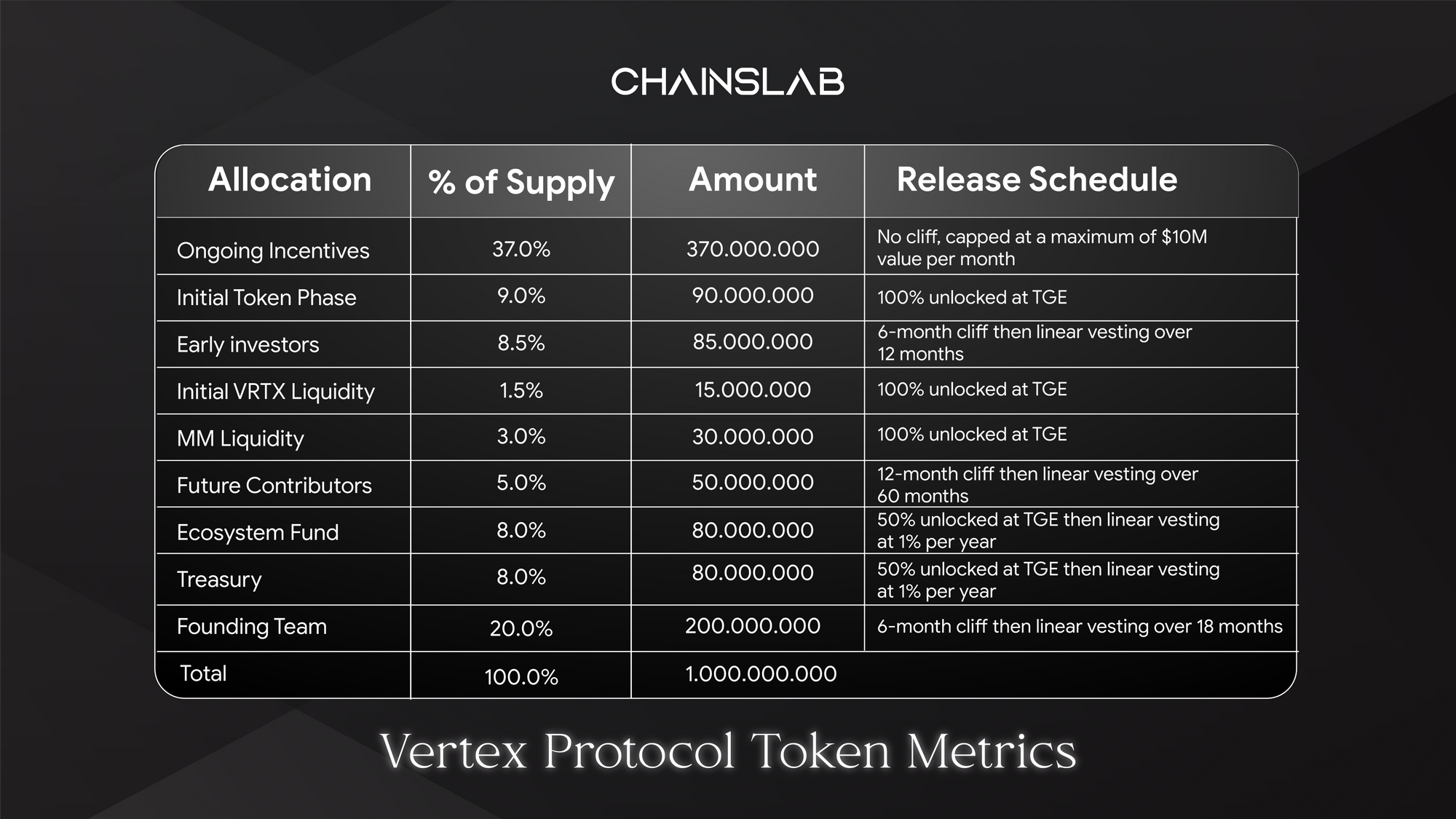

Token Distribution

The total supply of VRTX is fixed at 1 billion tokens that will be fully unlocked over a period of 5 years. Vertex was first closed for $8.5M in a Seed funding round originally on Terra network, backed by a lot of leading trading firms as well as market makers including, Hack VC, Jane Street, GSR, Huobi, etc. As of now, there is no disclosure about the launch plan or the valuation information of the early funding round. So, talking about the allocation, you can clearly see that there could be no more sale for investors. The only way to accumulate the initial VRTXs is to come and trade on the platform through its ongoing Trade & Earn Program.

This design is very beneficial for the price of VRTX, as there won’t be any selling pressure from retailers, or token flipping for quick profits from public sale. The only selling force from the community comes from 9% of the total supply as its allocation of Initial Token Phase, not a huge number. The initial token phase is primarily a trading incentive program that lasts almost 6 months, namely 168 days divided equally into 6 epochs, and 15 million VRTX in each epoch pool.

V. Final Thoughts

Recently, Vertex just received a strategic investment from Wintermute Ventures. These investors might act as liquidity providers for the protocol, creating a tight order book, and less IL for LP pools, reducing slippage and improving overall trading efficiency. This can increase trading volumes and enhance market depth, benefiting all participants.

Vertex’s products have many advantages compared to competitors, solving the problem of asset margin on CEXs, as well as the liquidity, processing speed and transaction fees of DEXs. One more thing, the tokenomic is community-centric design and has potential for future holders, as 46% of the total supply will be distributed to the community via incentive programs.

Although the FDV at initial launch is not disclosed yet, it’s difficult to determine which price level should be determined. However, the author will still pay attention to the protocol at listing, because as analyzed above, such tokenomics design is pơtential for initial pump.

Vertex is revolutionizing the decentralized exchange landscape on the Arbitrum network by introducing a fresh and contemporary version. Unlike many other DEXs, Vertex will incorporate all the customary features of a CEX. This includes a lending and borrowing market, a user-friendly bridging interface, seamless fiat on/off-ramp capabilities, as well as advanced trading tools such as cross-margin functionality, limit orders, and leverage options.

In addition, with vision in the next 2-3 years, new users get educated, who will tend to approach investment in a decentralized manner, instead of only tokens listed on CEXs. In result, there will be a certain number of users that will re-allocate their investments, and DEXs would be the first destination once they come to DeFi.