As the FTX decline in the market, derivative DEXs have ascended the throne as the dominating type of market for liquidity. However, these derivative DEXs still encounter major technical barriers when operating from Ethereum as the primary layer-1 network. Arbitrum and Layer-2s have been quickly adopted by DEXs, such as GMX, DYDX, and Vela, as they continue to grow in popularity beyond the success of their predecessors. Vela is one of the hottest derivative DEXs on Arbitrum, making it a promising choice for those looking to invest in the cryptocurrency market.

I. What is Vela Exchange?

Vela Exchange, formerly Dexpools, is a decentralized trading platform built on top of the Arbitrum network. It provides users with a secure and efficient way to trade cryptocurrencies in a decentralized manner. The use of the Arbitrum network allows for fast and low-cost transactions supported by robust hybrid on-chain and off-chain architecture, making Vela an attractive option for those looking to trade digital assets. The platform is designed to be user-friendly and offers a range of features aimed at improving the trading experience for its users. With a focus on security and privacy, Vela is poised to become a popular choice for those looking to participate in the growing world of decentralized finance.

Features of Vela Exchange

The trading process on Vela is similar to that of other decentralized exchanges, allowing users to buy and sell cryptocurrencies using a secure and transparent platform. Some of the features offered by Vela include:

- Order Book: Vela maintains a real-time order book that displays the current buy and sell orders for a particular cryptocurrency. This allows traders to see the current market price and make informed decisions about their trades.

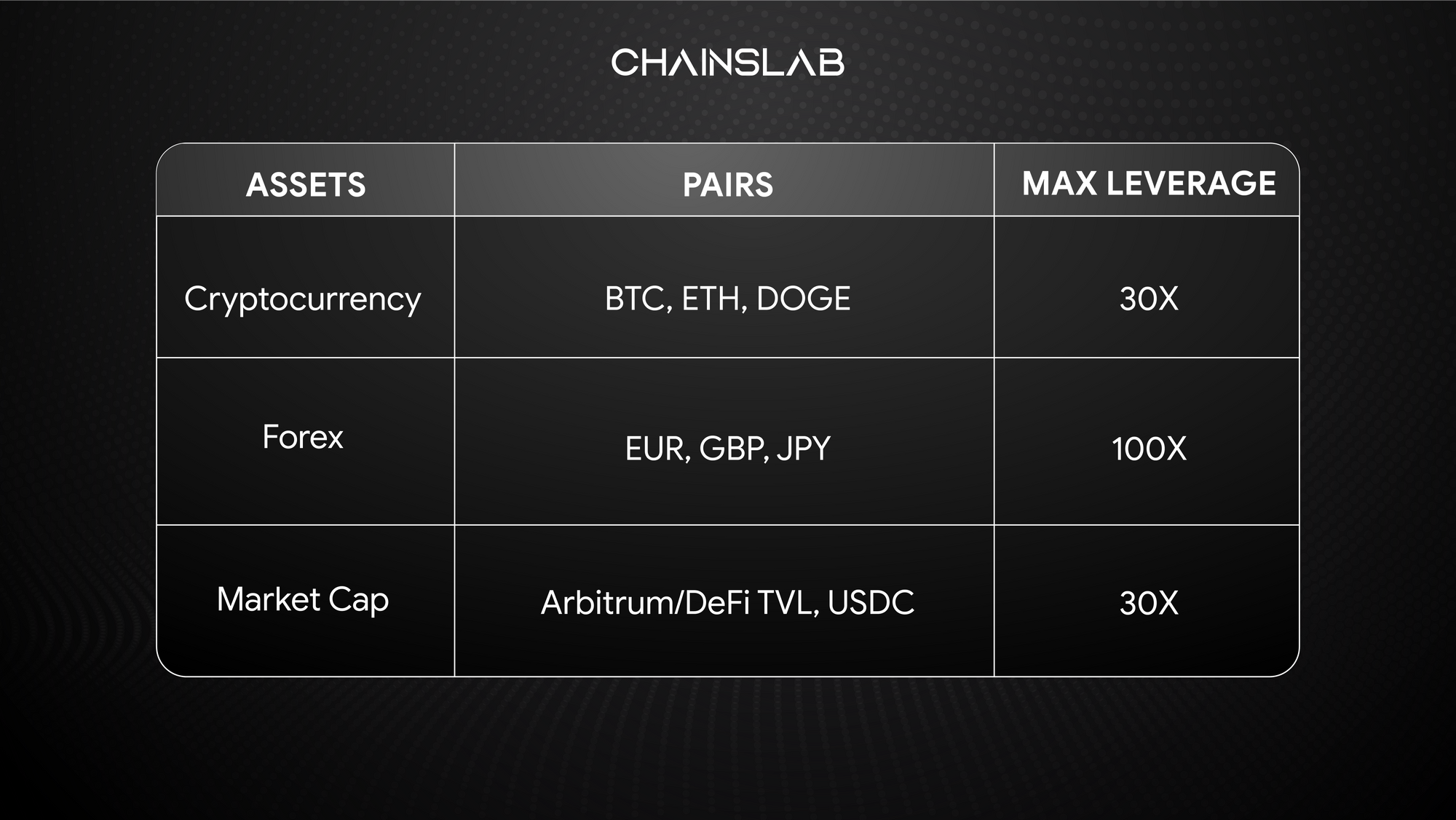

- Trading Pairs: Vela offers a range of trading pairs, allowing users to trade between different cryptocurrencies. This provides traders with flexibility and allows them to take advantage of price movements across multiple assets.

- Liquidity Pools: Vela operates liquidity pools, like GMX, which are pools of funds that are used to provide liquidity to the platform. This helps to ensure that there is always enough liquidity available for users to execute their trades, even during periods of high demand.

- Decentralized Nature: As a decentralized exchange, Vela operates on the Arbitrum network and is not controlled by a single entity. This provides users with greater security and privacy compared to centralized exchanges.

- User-Friendly Interface: Vela is designed to be user-friendly, with a simple and intuitive interface that makes it easy for users to trade cryptocurrencies. The platform is also mobile-friendly, allowing users to trade on-the-go.

In summary, Vela Exchange offers a range of features aimed at improving the trading experience for its users, while also providing a secure and transparent platform for trading cryptocurrencies.

II. Products of Vela Exchange

Vela offers a range of trading products, providing its users with a comprehensive suite of tools for buying and selling digital assets. The first core product is perpetual trading. Like other competitors, Vela offers fully on-chain order book perpetual exchange where users create positions against synthetic assets with up to 100x leverage.

The overall picture of decentralized exchange on spot and derivatives is quite active lately. It can be said that Arbitrum is really a new home for perp trading projects and Vela takes advantage of the network's high transaction speed, and low latency. This is an extremely important factor for perpetual trading, which requires the smoothest and most expeditious processing of information and transactions.

In addition to supporting spot trading, Vela also offers a decentralized OTC platform that allows P2P trading, in order to avoid the impact on prices or slippage when large orders occur. However, at the time of writing, all 3 products have not been released publicly, so evaluation of the experience is quite difficult and objective.

The trading mechanism of Vela is quite similar to GMX, traders' profits are extracted directly from the platform's TVL and conversely, losses are shared among liquidity providers. It means that when the market has a clear trend, uptrend/downtrend, traders often tend to open orders in the direction of the trend, which will be very harmful to the liquidity providers. This is a feature that the author personally doesn't really appreciate, even if the platform has a large total value locked.

III. Team & Partners

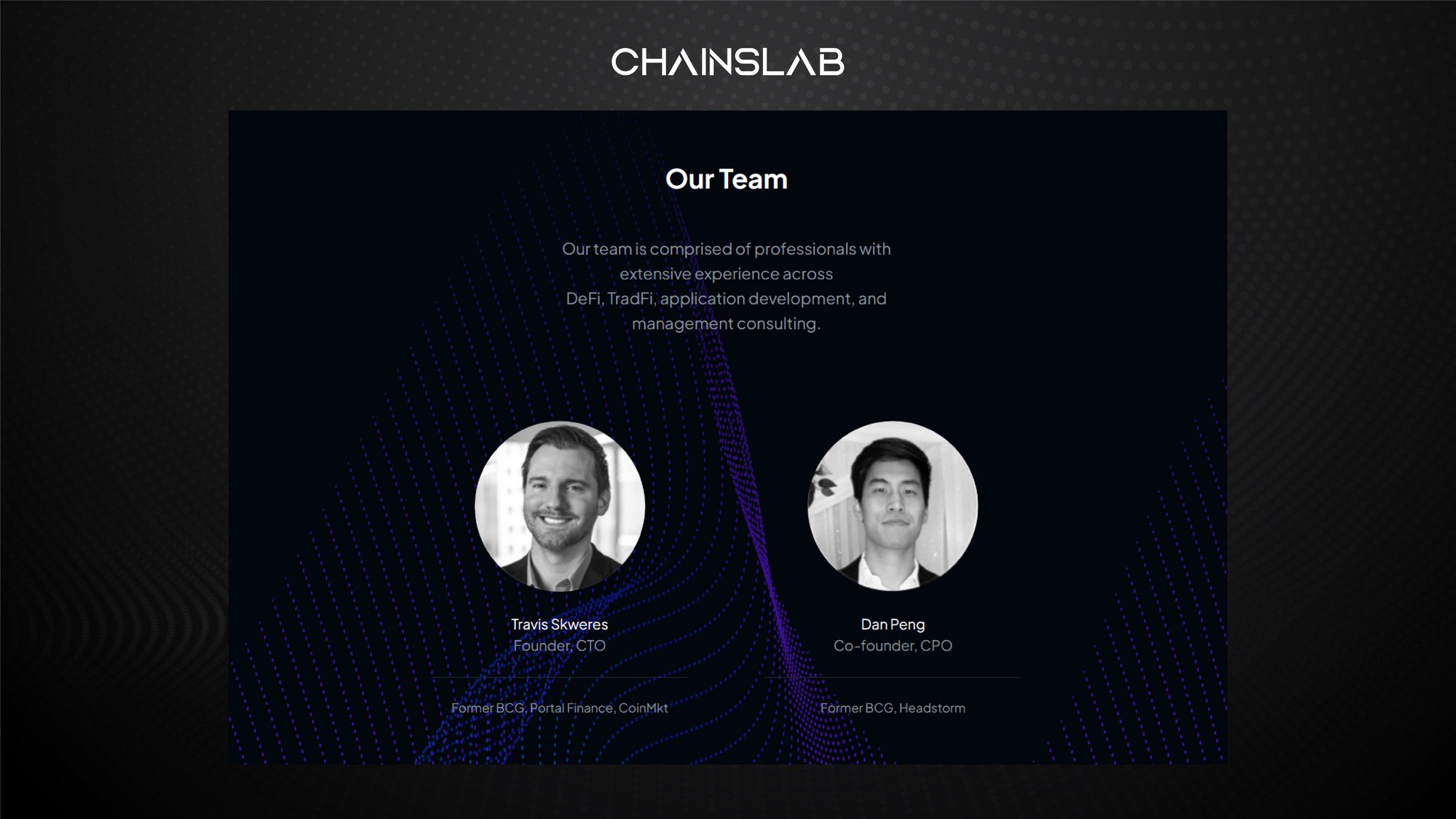

Vela Exchange was founded by Travis Skweres and Dan Peng. Both founders have had ample experience in the tech and consulting industries. Skewres has been involved in the cryptocurrency space since 2012 and founded Portal Finance which has since been acquired by Coinbase. The rest of the team and advisory board come from teams such as Balancer, Black Rock, BCG, and Polygon.

In terms of backers, the team has raised $2.1 million from various funding rounds and has strategic partnerships with Big Brain Holdings, Jade Protocol, Magnus Capital, Orange Dao, and Quantstamp.

IV. Tokenomics & Token Metrics

Token Metrics

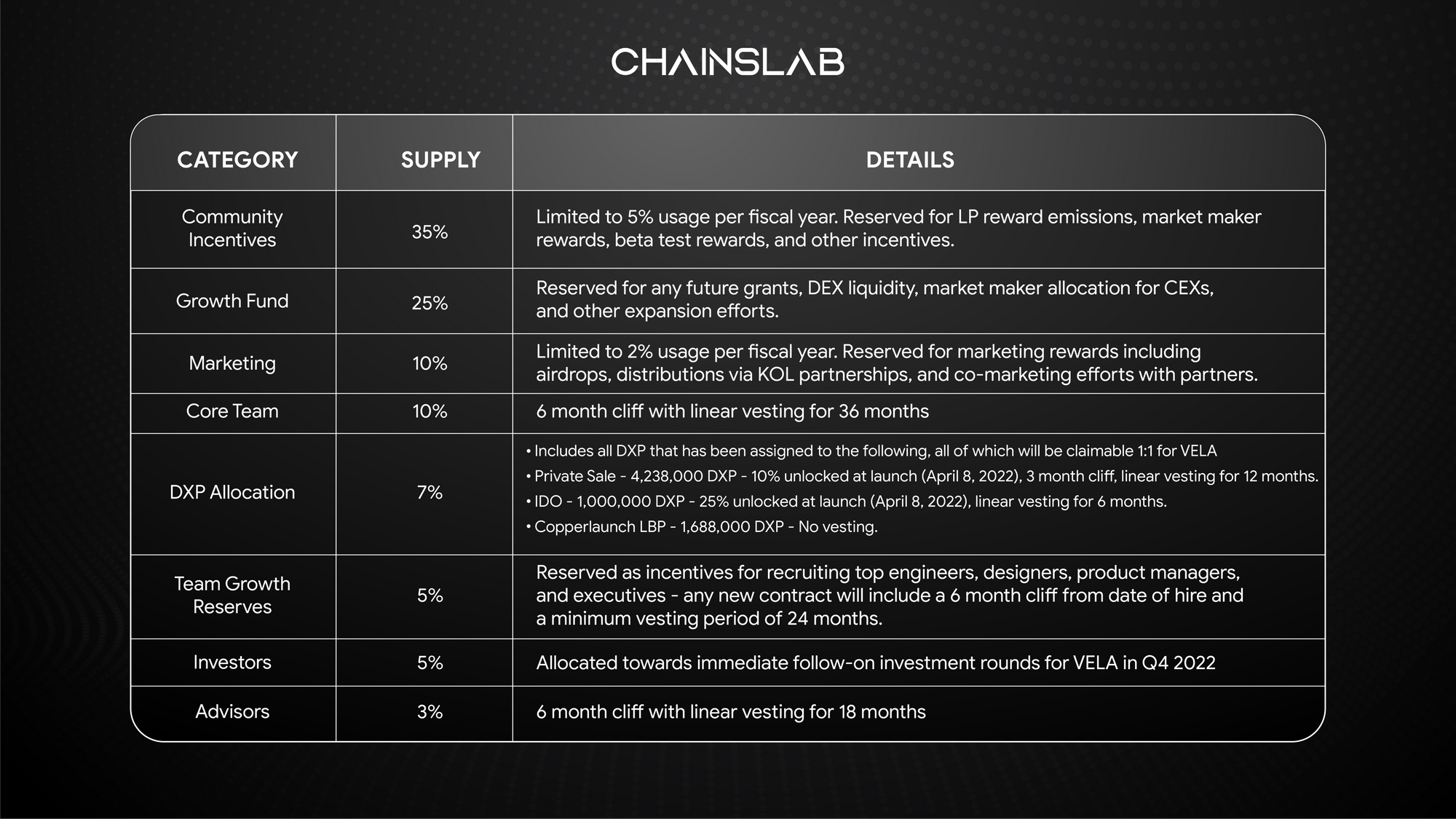

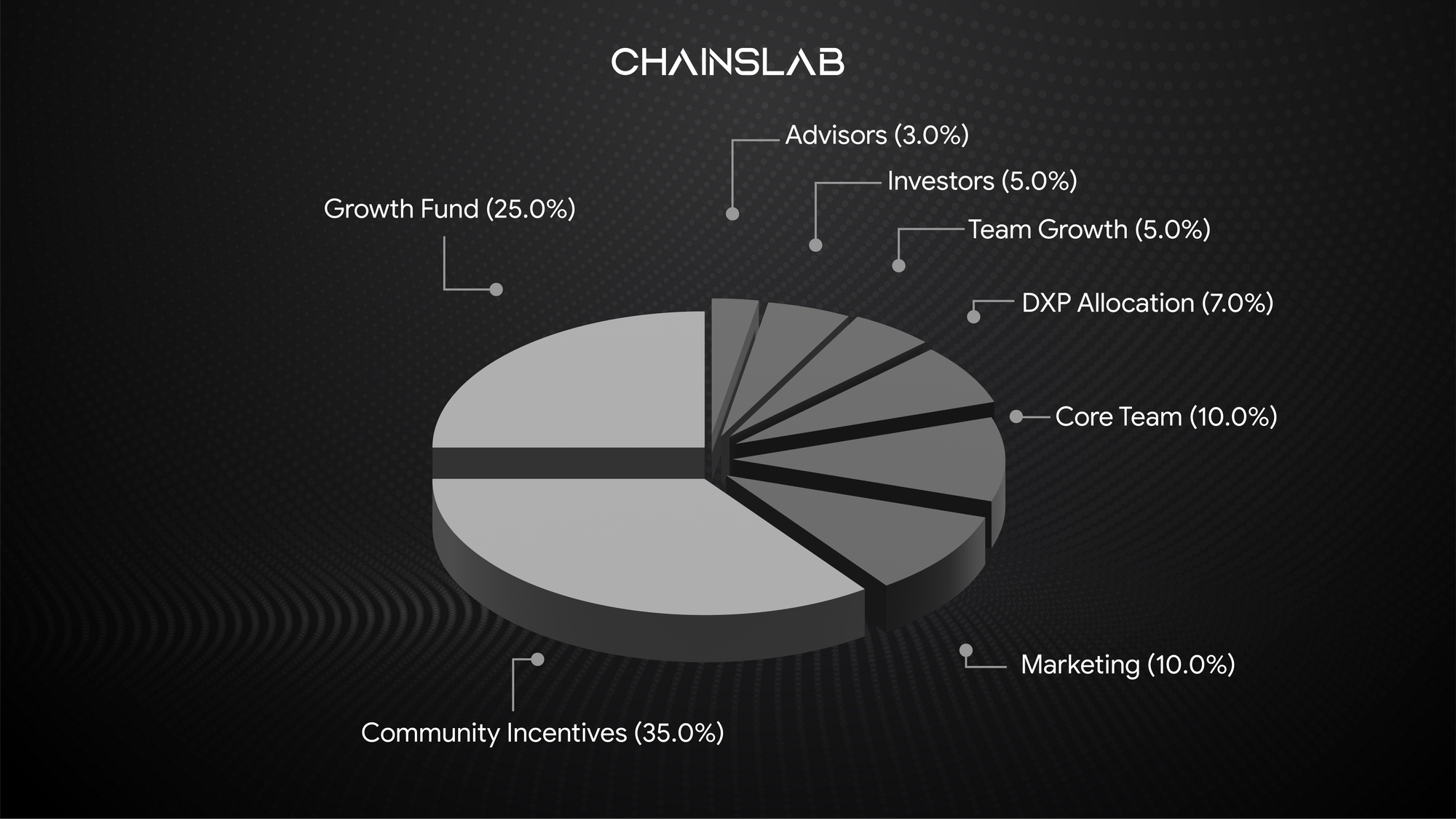

Vela Exchange is centered around its native token, VELA with a total supply of 100 million. But as reported from Arbiscan, it shows only 10 million in total supply. It causes confusion. However, the author will analyze based on the allocation for each category, and won’t go deep on current prices.

All tokens with vesting have begun vesting since April 2022. IDO round opening price, formerly DXP, was $0.5 and raised a total of $500k. And a fair launch round is open for sale on Copperlaunch LBP with starting prices ranging from $3-$4. The private sale was sold at $0.35 per token. Seed investors spent $2.1 million to purchase 5% of supply, which means the purchase price was $0.42. Overall, at the time of writing, VELA is at $2.8, thus, all round is profitable at least 5x.

The upside potential of VELA is plenty as in the coming weeks, the platform will open access to the entire community starting Feb 9th. In addition, the holding rate of retail investors is quite small, only accounting for about 7% of supply, and all tokens from the public sale have been fully unlocked and next July the private sale tokens will be fully unlocked.

Tokenomics

The token serves several key functions within the platform, including:

- Governance: VELA holders have the ability to participate in the governance of the platform, voting on key decisions such as upgrades and new features.

- Staking: VELA holders can stake their tokens to earn rewards for participating in the security and stability of the network.

- Liquidity Provision: VELA holders can provide liquidity to the platform's liquidity pools, earning rewards in exchange for helping to ensure that there is enough liquidity available for users to execute their trades.

- Trading Fees: VELA can be used to pay trading fees on the platform, providing a discount compared to fees paid in other cryptocurrencies.

- Access to Premium Features: VELA holders may have access to premium features on the platform, such as advanced trading tools and analytics.

The tokenomics of Vela Exchange are designed to incentivize users to participate in the platform and support its growth. By holding and using VELA, users can benefit from lower fees, access to premium features, and rewards for staking and providing liquidity. The token also provides a mechanism for decentralized governance, allowing VELA holders to shape the future direction of the platform. All these use cases would create more demand for purchasing and holding the token.

V. Evaluation on Vela Exchange

It is important to note that the success of Vela will also depend on the success of the Arbitrum network, which may be a risk factor for some users. And marketing team to attract more users. These requires the level of user adoption and engagement on the platform, as well as the level of activity and liquidity on its trading pairs.

Honestly, decentralized derivative trading platforms are not too strange in the market when the number of projects grows too much. However, Vela is offering OTC trading as well, creating more advantages compared to competitors. Failing to attract liquidity results in slow execution and high spreads/slippage on order book DEXs. Order book DEXs technically, incentivize users to provide liquidity under the form of VLP, similar to GMX’s GLP or dYdX market maker rewards.

Vela Exchange, being an order book DEX, makes use of GMX’s GLP incentivized liquidity model as well as offer incentives for market makers, thus ensuring that the protocol can get off the ground running in terms of attracting liquidity. However, unlike dYdX in its current state, VELA is non-inflationary and can be sustained by protocol revenue in the long-term growth.

As a latecomer, Vela has many lessons learned from her predecessors. In Vela Exchange’s favor, the highly competitive landscape means that the protocol must stand out against the crowd by providing best-in-class UX, CEX-like functionality, and security.

In addition, Arbitrum is hot, predicted to become the next narrative in the next few months. Ultimately, we still have to wait for the official launch to see their developments and progress.