Decentralized borrowing and lending protocols have emerged as a popular use case for blockchain technology in the decentralized finance (DeFi) ecosystem. These protocols allow users to lend and borrow digital assets without the need for traditional financial intermediaries, such as banks or lending institutions.

One of the key components of these protocols is the use of stablecoins, which are cryptocurrencies that are pegged to the value of a fiat currency, such as the US dollar. Stablecoins help to mitigate the volatility of cryptocurrencies and provide a stable unit of account within the DeFi ecosystem.

Liquity is a decentralized borrowing protocol that has gained traction in the DeFi space due to its unique approach to stablecoin lending. Unlike traditional lending platforms, Liquity offers 0% interest loans against Ethereum collateral, with loans paid out in LUSD, a USD-pegged stablecoin. The protocol also requires a lower minimum collateral ratio of 110%, making it more accessible to a wider range of users.

In this article, we will provide a comprehensive overview of Liquity, as a decentralized borrowing protocol, including its market overview, borrowing mechanism, tokenomics, impact on DeFi, and more. We will explore how Liquity differs from other borrowing protocols in the DeFi space and discuss the potential implications of this platform for the broader financial ecosystem.

I. So, what is Liquity?

Decentralized borrowing and lending protocols have seen tremendous growth in the DeFi space over the past few years, with the total value locked (TVL) in DeFi protocols surging from just $1 billion in mid-2020 to over $100 billion by early 2022. However, the borrowing market within DeFi is still dominated by a few major players, including Aave, Compound, and MakerDAO.

Despite facing stiff competition, Liquity has gained significant traction in the DeFi borrowing market due to its unique approach to stablecoin lending. Unlike other borrowing protocols that charge interest rates on loans, Liquity provides 0% interest loans against Ethereum collateral, with loans paid out in LUSD, a USD-pegged stablecoin.

One of the key advantages of Liquity is its lower minimum collateral ratio of 110%, compared to the 150% required by MakerDAO and 125% required by Compound. This makes it easier for users to access credit without having to put up as much collateral, which can be especially important for those with smaller amounts of capital to invest.

In addition to its competitive offerings, Liquity has also seen impressive growth and adoption within the DeFi ecosystem. As of early 2022, Liquity had over $3 billion in total value locked and had issued over $2 billion in loans. This growth has been driven in part by the protocol's user-friendly interface and the community-driven development of the Liquity ecosystem.

Compared to other borrowing protocols in the DeFi space, Liquity offers several unique selling points and advantages. Its 0% interest loans, lower minimum collateral ratio, and USD-pegged stablecoin payouts make it an attractive option for users looking for accessible and flexible borrowing options.

Overall, Liquity's growth and adoption in the DeFi space suggest that it has the potential to disrupt traditional lending and borrowing markets by offering a more accessible and user-friendly approach to stablecoin lending. As the DeFi ecosystem continues to evolve, it will be interesting to see how Liquity and other decentralized borrowing protocols shape the future of finance.

II. How Liquity Works

Liquity's borrowing mechanism is designed to be simple and user-friendly, allowing borrowers to draw loans against Ethereum collateral without having to worry about high interest rates or complex repayment structures. Here is a step-by-step guide on how to draw a loan on Liquity:

- First, the borrower must connect their Ethereum wallet to the Liquity platform and deposit ETH as collateral. The collateral must be at least 110% of the value of the loan they wish to draw.

- Once the collateral is deposited, the borrower can create a Trove, which is a smart contract that manages their ETH collateral and LUSD debt. The Trove is created by borrowing LUSD against the collateral at a collateralization ratio of 110%.

- The borrower then receives the borrowed LUSD in their wallet, which they can use as they see fit. The loan can be repaid at any time, either by depositing LUSD or by increasing the collateral in the Trove.

- To maintain the minimum collateral ratio of 110%, the Trove is subject to stability fees, which are calculated based on the total LUSD debt and are paid in ETH. These fees are used to maintain the stability of the LUSD stablecoin and to incentivize users to keep their Troves adequately collateralized.

While Liquity's borrowing mechanism is relatively straightforward, there are several risks associated with using the protocol. One of the biggest risks is the possibility of liquidation, which occurs when the collateral in a Trove falls below the minimum collateral ratio. In this case, the Trove is liquidated, and the collateral is sold to repay the LUSD debt. This can result in the borrower losing a portion of their collateral if it is sold at a lower price than the value of the LUSD debt.

Another risk is the volatility of Ethereum prices, which can affect the value of the collateral in a Trove. If the price of Ethereum drops significantly, the borrower may need to add more collateral to maintain the minimum collateral ratio or risk liquidation. Therefore, it is important for borrowers to carefully monitor their Troves and the value of their collateral to avoid liquidation and minimize risks.

Overall, Liquity's borrowing mechanism offers a user-friendly and accessible approach to stablecoin lending, but it is important for borrowers to understand the risks involved and to carefully manage their Troves to avoid liquidation and other potential losses.

III. Liquidity Tokenomics

Liquity's native token is LQTY, which plays a crucial role in the protocol's operations and governance. Here is an overview of LQTY's use cases and Liquity's tokenomics structure:

Use cases:

- Governance: LQTY holders can propose and vote on changes to the Liquity protocol, including changes to the stability fee, minimum collateral ratio, and other parameters.

- Collateral pool: LQTY tokens are used to collateralize the system's Stability Pool, which is used to buy and burn LUSD in order to maintain its price stability.

- Discounted stability fees: Borrowers can stake LQTY in the Stability Pool to receive a discounted stability fee on their Trove.

Liquity's distribution model:

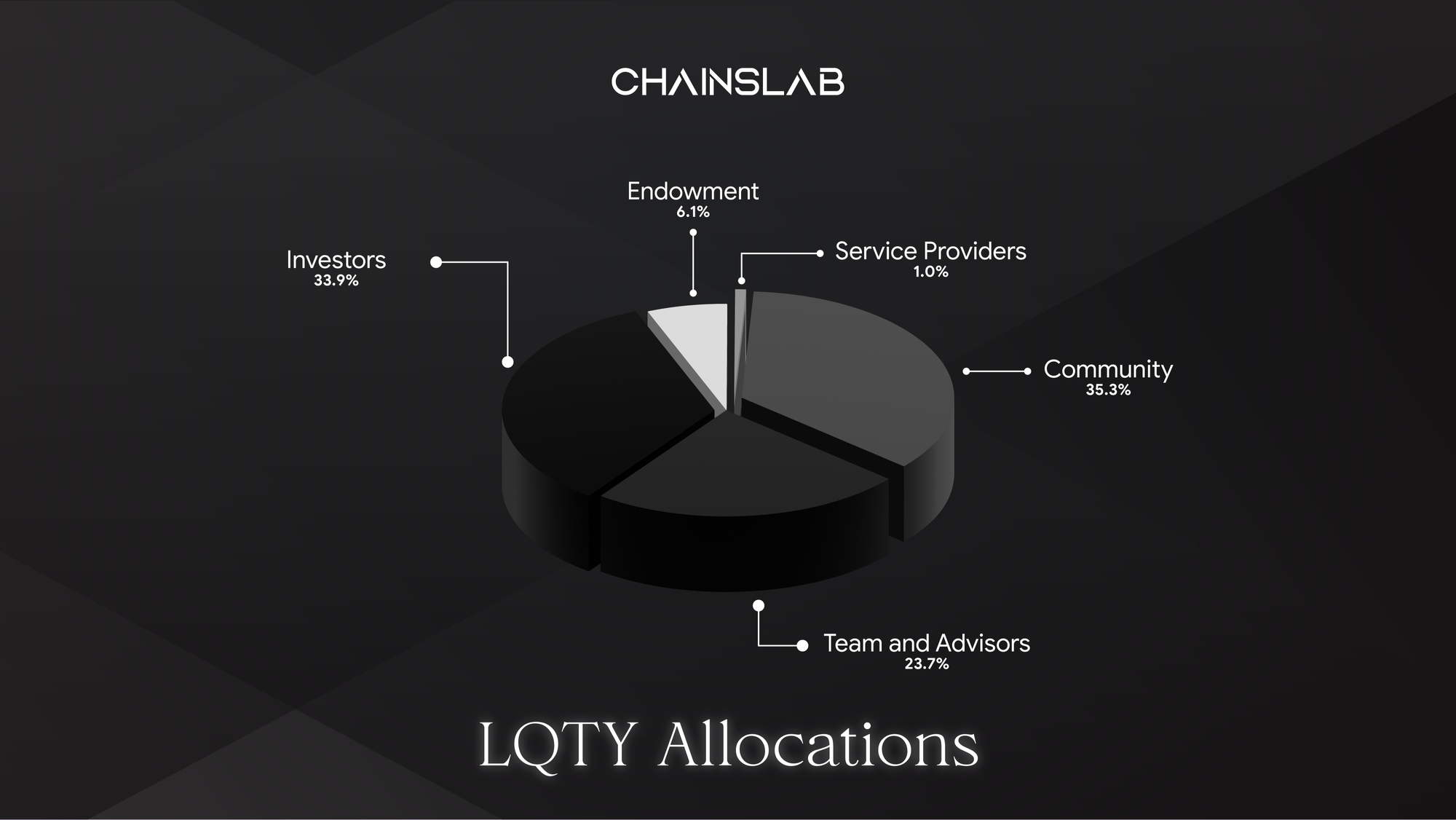

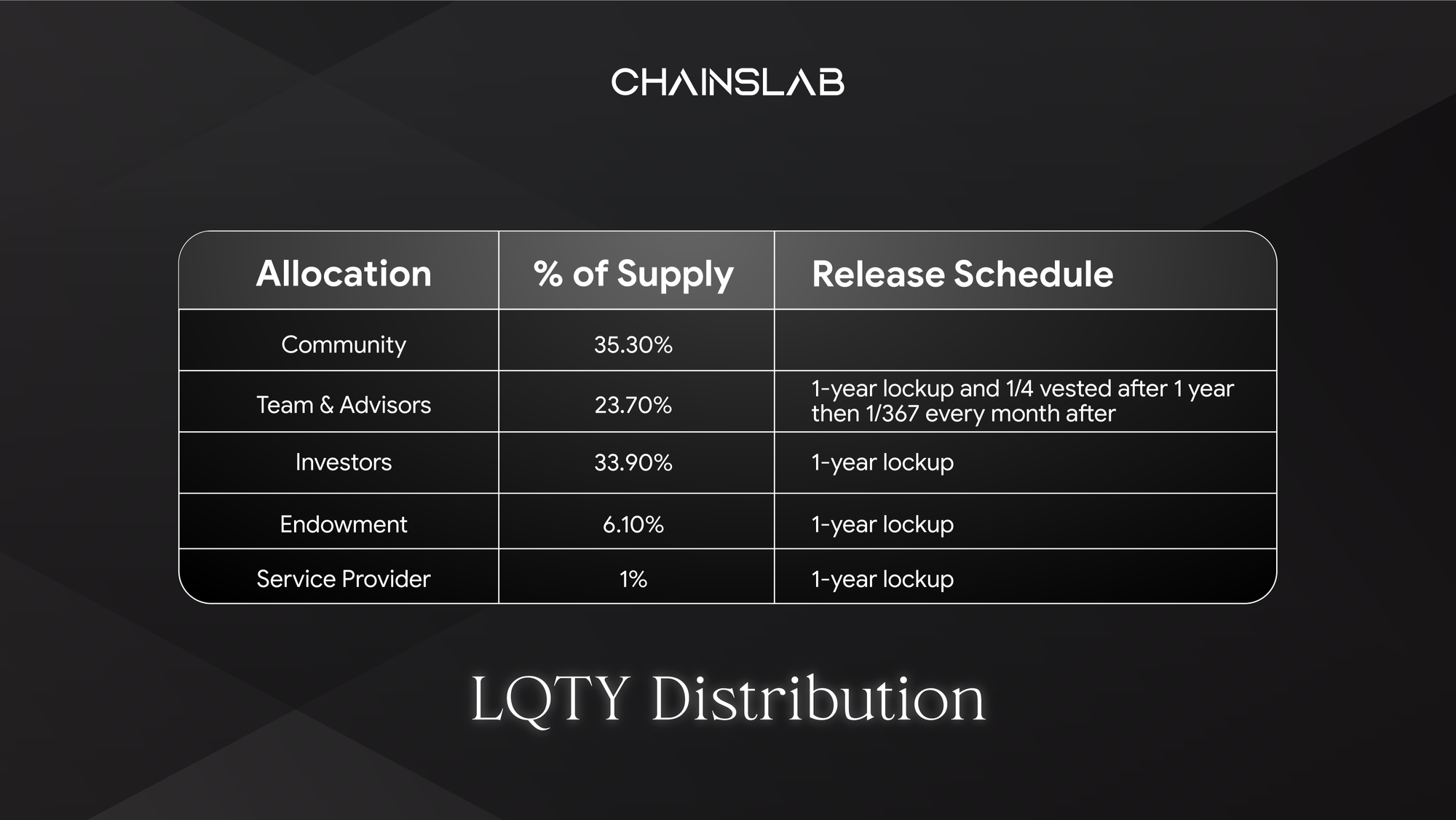

Liquity's token distribution model is designed to incentivize participation in the platform and to reward early adopters. A total of 100 million LQTY tokens were minted at launch, with the following distribution:

One unique aspect of Liquity's tokenomics is that the stability fee generated by the protocol is used to buy back and burn LQTY tokens. This reduces the circulating supply of LQTY and creates a deflationary effect on the token's value.

From a personal point of view, circulating Supply has now reached about 91%, so the dump supply from any holder seems to no longer affect too much token. However, in order for the token to increase the value, protocol requires enough activities to turn LQTY into a sustainable reduction token in the long-term.

IV. Closing Thoughts

Liquity is a decentralized borrowing protocol that offers a unique alternative to traditional lending and borrowing markets. Its unique selling points, including 0% interest loans and low collateral requirements, have the potential to disrupt the lending industry by making borrowing more accessible and affordable for a wider range of users.

In the broader DeFi ecosystem, Liquity's impact has been significant. It has attracted a growing number of users who are looking for alternatives to traditional financial services. Its use of stablecoins and smart contracts to create a trustless and transparent lending environment is seen as a major advantage over centralized lending platforms.

Looking ahead, the future for Liquity and decentralized borrowing protocols in DeFi looks promising. As more users discover the benefits of these platforms, we can expect to see continued growth and adoption.