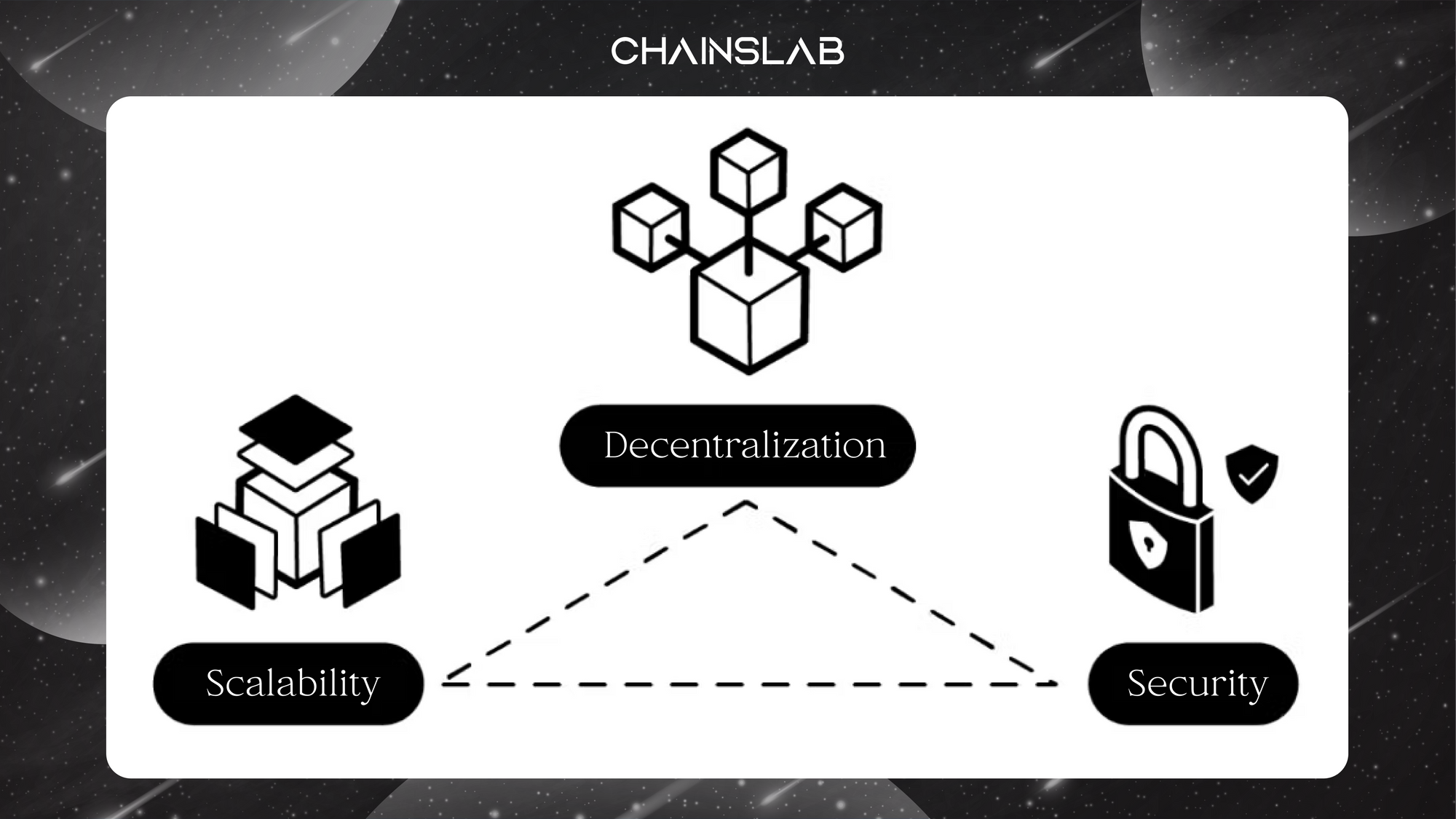

If you have been around the cryptosphere for a couple of months, you have likely heard about the blockchain trilemma. In a nutshell, it describes the tradeoff of a monolithic blockchain between scalability, security, and decentralization a blockchain has to make in its architecture. Blockchains like Bitcoin, Ethereum, and Solana are monolithic in structure and have four core functions: data availability, consensus, settlement, and execution. Since security tends to be an aspect you do not want to sacrifice a lot, it usually comes down to weighing scalability against decentralization. So far, we have seen some scaling solution approaches such as Layer-2s, rollups.

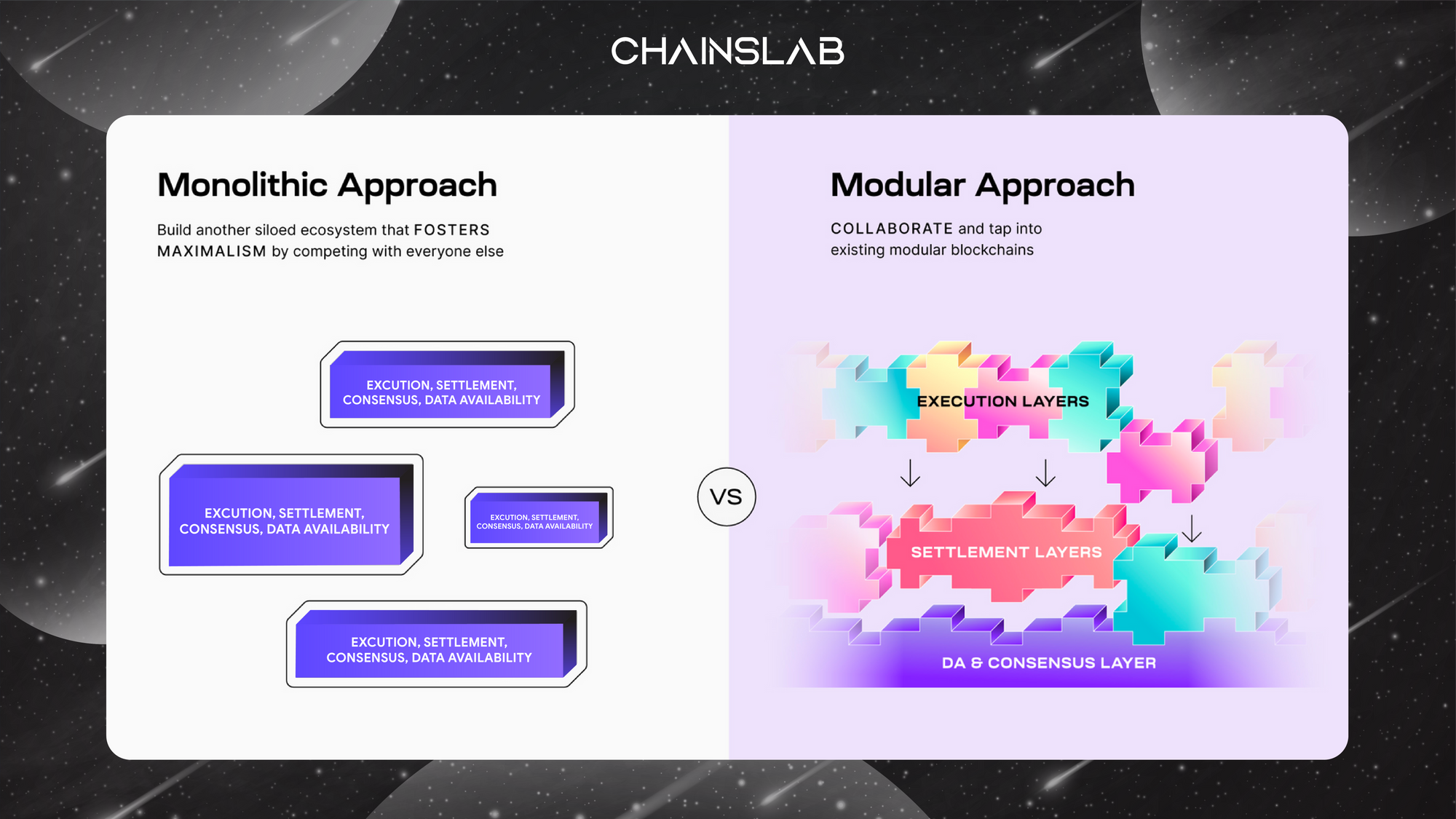

However, what about rethinking how we set up blockchains in general? A disaggregated blockchain separates settlement, execution, consensus and data availability into multiple specialized layers, not all in one layer as many current mainstream blockchains.

In this article, we dive into Celestia - a modular Layer 1 proof-of-stake blockchain and explain its architecture and ecosystem as well as comment on our findings.

I. What is Celestia?

Celestia is the first modular blockchain network. Thus, they fundamentally differ from the established framework of monolithic blockchains (Don´t worry, we will dive into an easy-to-understand explanation of monolithic vs. modular blockchains later). They decouple the formerly unified consensus and execution layer and use data availability sampling (DAS) to ensure that the transaction data is retrievable.

However, Celestia´s nodes are not concerned about their validity since the rollup layers on top take care of that. By separating the three essential functionalities of blockchains (consensus, execution, and data availability), Celestia enables teams to deploy new blockchains effortlessly and fosters the spread of more app-specific chains. Developers and communities can deploy their own custom-made blockchains at the “clock of a button.”

This way, users won’t have to depend on Celestia’s design and governance choices. They can choose a settlement layer, launch their very own, or even launch their own roll-up while benefiting from Celestia’s infrastructure and security. Through this approach, Celestia is able to offer flexibility, interoperability, and scalability, yet unseen by existing blockchain designs.

II. Monolithic vs. Modular Blockchains

- The first approach to building blockchains was a monolithic design where a single blockchain does everything. However, the monolithic approach poses multiple problems.

- Modular blockchains are a departure from the monolithic approach by pursuing specialization. Namely, modular blockchains decouple consensus from execution.

- Modular blockchains optimize for a future of collaboration, flexibility, and sovereignty that strives for principles that empower people and communities first.

Problems of Monolithic

Because of the monolithic approach of trying to do everything, monolithic chains face a number of problems.

- High hardware requirements: Monolithic chains can increase the number of transactions they process, but it comes at a cost. That cost is higher hardware requirements for nodes to verify the chain.

- Bootstrapping validators: Deploying a new monolithic blockchain requires the overhead of bootstrapping a secure validator set and maintaining a consensus network.

- Limited control: Apps must follow the predetermined rules of the chain they deploy to. This includes the programming model, ability to fork, and community culture, among others.

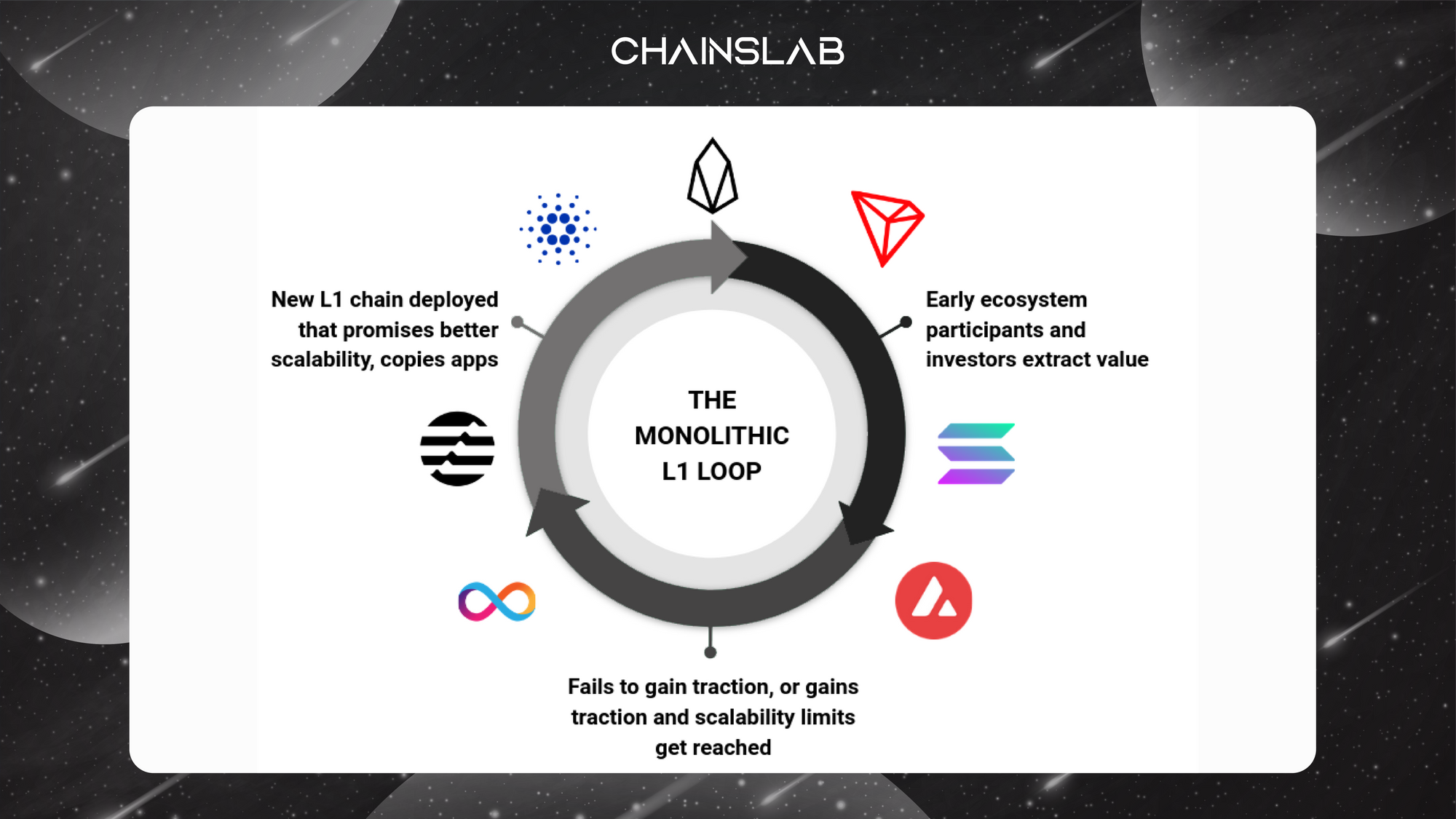

Although it has only been developing strongly for a few years, it is probably impossible to count the number of Layer 1 blockchains on the market right now. Each new blockchain is born to fix the problems of the Layer 1s in the previous cycles.

Each monolithic chain continues to build its own walled-off ecosystem. Fragmented tech causes friction for developers to move between ecosystems and clunky experiences for users. The L1 loop continues, fostering more maximalism among communities. Collaboration is missing when the fight for users is considered a zero-sum game.

Benefits of Modular

Celestia is designed to deliver a number of key benefits for Web3 developers, including: scalability, shared security, and sovereignty.

- Scalability

A core idea of modular blockchains is that they separate functions across multiple chains. This concept also brings extra scalability. A modular L1 like Celestia can now specialize in data availability. Without smart contracts, the L1 can focus all its resources on providing data for L2s. Specialization is key because more data the L1 can provide allows rollups to process more transactions.

In the monolithic world, all apps live on the same chain. The downside is that users of different applications all have to compete and get in the line of “gas war” to get their transactions processed. In the modular paradigm, apps live on separate chains, and transactions for many different apps can get processed at the same time.

- Shared Security

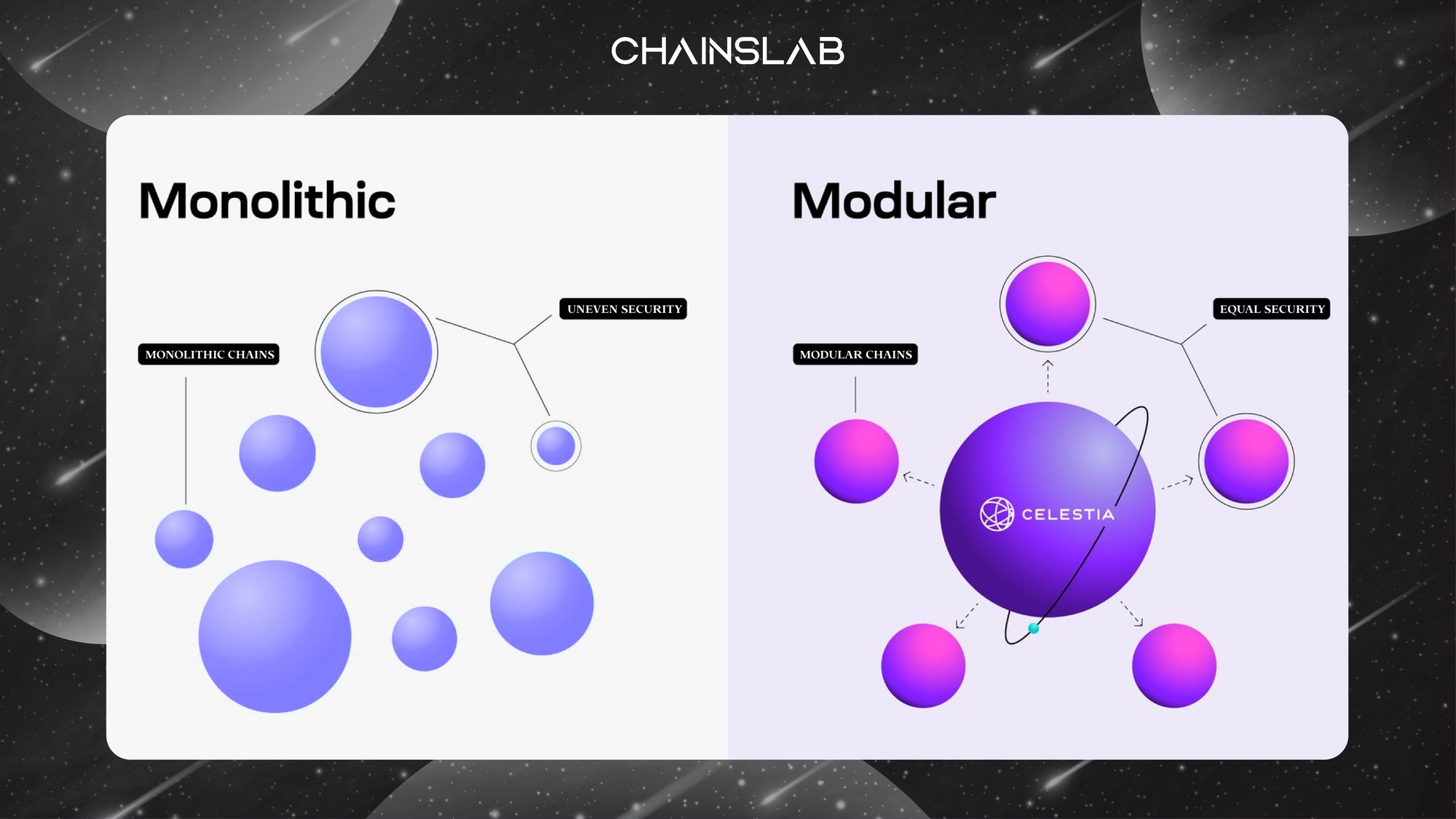

Each time a new monolithic blockchain launches, a crucial part of the process is that they must bootstrap their own validator set. Differences between chains leads to uneven security in an ecosystem of monolithic chains. A few will have high security with large validator sets (Ethereum), while many others will have low security (BNB Chain) with small validator sets. If we expect thousands of chains or more to make up the multi-chain ecosystem, we can’t expect each one of them to have enough security.

With shared security, deploying new blockchains like rollups doesn’t require bootstrapping a new validator set. Security is provided to blockchains by a common source, like Celestia. A new blockchain can deploy to Celestia and immediately tap into the security that it has built.

- Sovereignty

When an app is built on a shared monolithic blockchain, it is bound by predetermined rules. The rules might be around social consensus (when it's okay to hard fork) or around technical rules (what programming languages you can write smart contracts in).

Modular blockchains enable control over the rules of an application through sovereignty. Developers can make changes to the tech stack without permission from outside applications. Importantly, sovereignty gives independence. Developers and the community can freely set the rules for their sovereign chain that aligns with their app and community’s ethos.

III. Limitations of Celestia

Celestia is pioneering a completely new blockchain design. While we believe this is a superior model to existing solutions there remains some unexplored challenges.

The first challenge we foresee has to do with determining appropriate block sizes. As we explored throughout this post, Celestia’s block sizes can be safely increased with the number of data sampling nodes in the network. However, data sampling is not a Sybil-resistant process. Hence, there is no verifiable way to determine the number of nodes in the network. Furthermore, since nodes that participate in sampling can’t be explicitly rewarded by the protocol, assumptions with regards to sampling have to rely on implicit incentives. The process to determine and update target block size will be governed by social consensus which is a new challenge in consensus governance.

Another challenge ahead has to do with bootstrapping network effects on Celestia. Obviously, a specialized DA layer without execution doesn’t serve much purpose. Unlike other blockchains, Celestia will therefore be relying on other execution chains to kickstart user activity. To this end, one of the initial use cases of Celestia will be to serve as an off-chain DA solution for validiums on Ethereum (ie. Celestiums). Celestiums are the lowest hanging fruit for Celestia kickstart activity on its blockspace.

Finally, there is a limitation we foresee that has to do with Celestia’s native token utility. Just like any other chain, Celestia will have a fee market, where its native token will accrue value from demand for Celestia’s blockspace. However, because Celestia doesn’t perform state execution (except for a very tiny state execution for PoS related activities), unlike most chains, its token’s utility as a liquidity source in DeFi and other verticals will be somewhat limited. For example, unlike ETH which can freely move between rollups and Ethereum in a trust minimized way, Celestia’s native token will have to rely on trusted bridges to be ported over to other chains.

IV. Team

Celestia is being built by Celestia Labs. The founders of Celestia have all had ample experience in building and scaling blockchains, in addition the Celestia team is composed of engineers with experience in Google, AWS, Oracle, and other blockchain projects like Ethereum and Cosmos. Founded by Mustafa Al-Bassam, Ismail Khoffi, and John Adler. Al-Bassam holds a PhD in blockchain scaling and co-authored a paper on fraud and data availability proofs alongside Vitalik Buterin. Adler is also the co-founder of Fuel, a modular blockchain execution layer.

V. Backers

In terms of funding, Celestia closed a seed round of $1.5 million back in 2021, with participation from Interchain Foundation, Binance Labs, and Maven 11, among others.

Recently, the Celestia Foundation announced $55 million in support from rounds led by Bain Capital Crypto and Polychain Capital with participation from Placeholder, Galaxy, Delphi Digital, Blockchain Capital, NFX, Protocol Labs, Figment, Maven 11, Spartan Group, Jump Crypto, and select angels including Balaji Srinivasan, Eric Wall and Jutta Steiner.

VII. Conclusion

Modular blockchain solutions like Celestia give developers a wide range of options to not only scale blockchains, but to enable cross-chain interoperability as well. The real test, however, would be to see how all this plays out in reality. We think that the future is one that involves a multitude of modular app-specific or purpose-specific chains that are both scalable and interoperable.

The author believes modular blockchains are a paradigm shift in blockchain design and expect their network effects to become increasingly more apparent over the course of the next few years. Particularly with the expected launch of Celestia’s mainnet in 2023.

By decoupling execution from consensus Celestia not only achieves Bittorrent style scaling and decentralization, but also offers unique advantages including trust minimized bridges, sovereign chains, efficient resource pricing, simpler governance, effortless chain deployment, and flexible virtual machines.

For the latest on layer 1 blockchains and other technologies, head over to the Chainslab Twitter to keep yourself always updated.

Celestia

Website | Twitter | Discord | Telegram

Chainslab