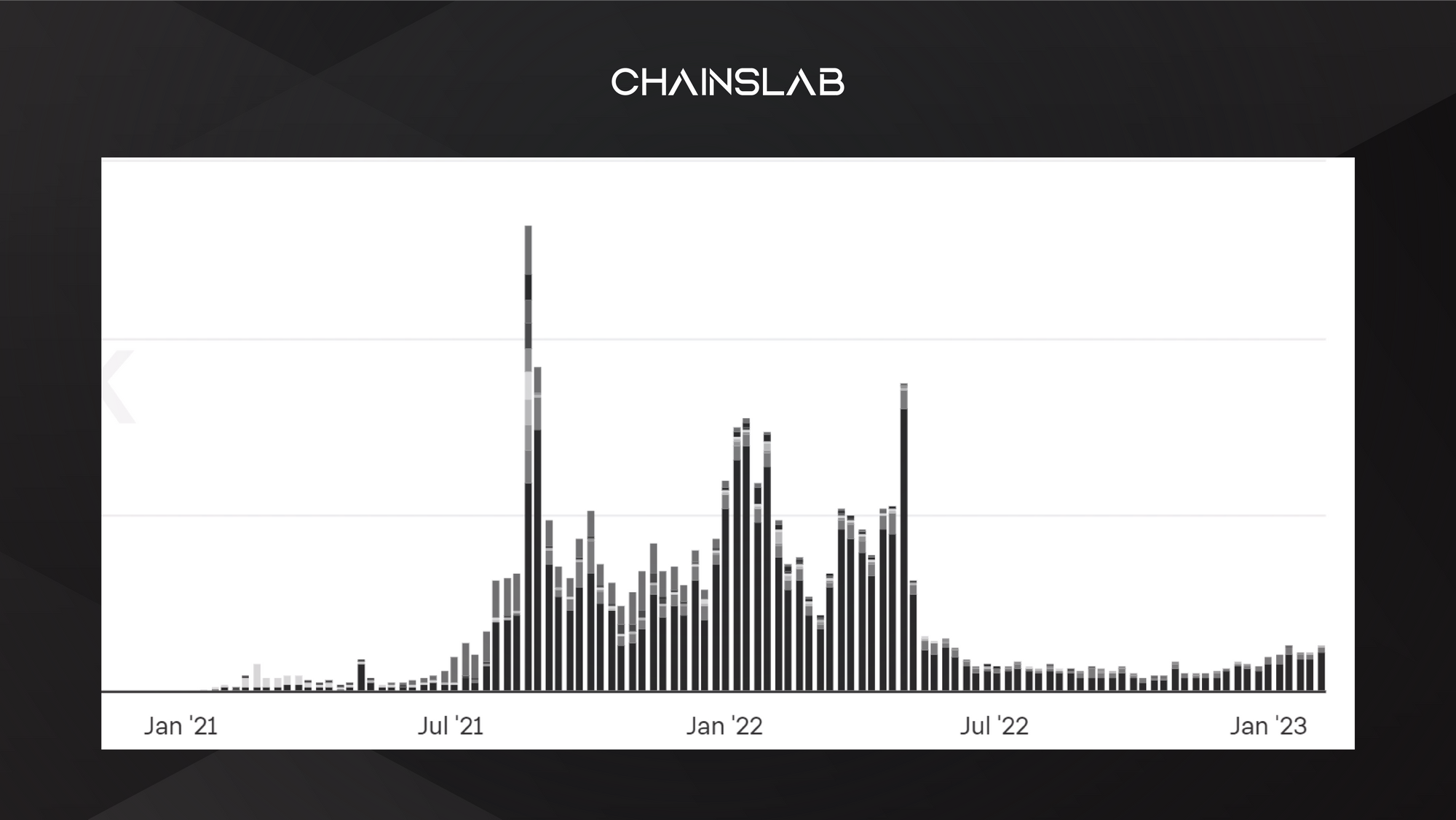

Despite months of declining sales and falling prices, overall, NFT sales volume on OpenSea last year nearly matched the 2021 peak, according to boards from Dune. The data suggest that a buzzy start to the NFT market in 2022 buoyed the year-end tally and helped make up for the several weaker months that followed. The marketplace OpenSea generated around $24 billion worth of organic trading volume in 2022 across blockchain platforms. That’s a slight dip from the record of $25 billion in 2021, as the NFT market surged in activity and interest as tokenized collectibles first became more than a niche interest. Clearly, there has been phenomenal growth in the NFT space.

While there is heightened awareness around NFTs, the high price of some have proven to be a challenge. As the technology is still developing, the prices of NFTs can be very expensive due to scarcity and limited supply, as well as the low liquidity of some of the tokens. This makes investing in NFTs highly risky and speculative for many, who oftentimes have limited understanding of the technology.

Notwithstanding, with the recent explosion that both the NFT and DeFi markets have undergone, it was only a matter of time before the two technologies would inevitably cross paths. In our view, NFTs have the potential to become a ubiquitous internet primitive. The author envision a world where all economic verticals will make extensive use of NFT in decentralized finance, or NFTFi.

I. WTF is NFT Finance (NFTFi)?

It is important to note that NFT finance is still a relatively new and developing field. The main issue with NFTs is the lack of liquidity. Since each token is unique, it can be difficult for buyers and sellers to come together for trades, and the lack of liquidity may discourage investors from entering the market. Additionally, since the NFT market is still in its early stages and the space is highly unregulated, buyers may be at increased risk due to the lack of protection compared to more established asset classes. The lack of regulation and limited market size also makes it difficult to accurately determine the fair market value of each token. Furthermore, since the transactions are done on blockchains, there can be significant transaction costs and delays associated with the transactions.

NFT finance refers to the use of non-fungible tokens as a financial instrument for investment and transactions. It enables investors to purchase, store, and trade digital assets such as arts, collectibles, and other digital content. NFTs provide a unique way to own digital assets and to benefit from the appreciation of the asset’s value. NFTs are held digitally in a special digital wallet and can be bought and sold like any other cryptocurrency, allowing investors to diversify their portfolio and to take advantage of trends in the market.

NFTFi is using NFT to financialize through accessing more liquid assets. This collision of DeFi and NFT has opened up a variety of possibilities for NFT holders by making their NFT a much more liquid asset. Additionally, NFTs can be used to tokenize real-world assets such as artworks, real estate and adding additional layers of liquidity and security to these types of investments.

II. NFT meets DeFi

At present, DeFi protocols aim to imitate traditional finance systems. However, with the advent of NFTs, there is the possibility for the creation of an entirely new set of financial products. DeFi plays a key role in the NFT ecosystem. DeFi refers to a financial system that operates on a blockchain and is not controlled by any central authority.

In the NFT space, DeFi enables the creation of new financial instruments and investment opportunities through the use of NFTs. For example, NFTs can be used as collateral to secure loans or as a form of security in NFT marketplaces. Additionally, DeFi protocols can be used to manage the distribution of royalties and other revenue streams associated with NFTs.

DeFi also enables greater transparency and security in NFT transactions. By using blockchain technology, DeFi allows for the creation of a public ledger of NFT transactions that is immutable and transparent. This provides a secure and transparent way to verify the ownership and authenticity of NFTs, which is important for building trust in the NFT market.

Overall, DeFi and NFTs complement each other in the NFT ecosystem and have the potential to create new investment opportunities, revenue streams, and financial instruments. By enabling the creation of decentralized financial instruments and markets, in either case, NFT and DeFi projects exploit the strengths of each technology to offer a product that is patently more valuable than the sum of its parts.

III. Why does NFT need DeFi?

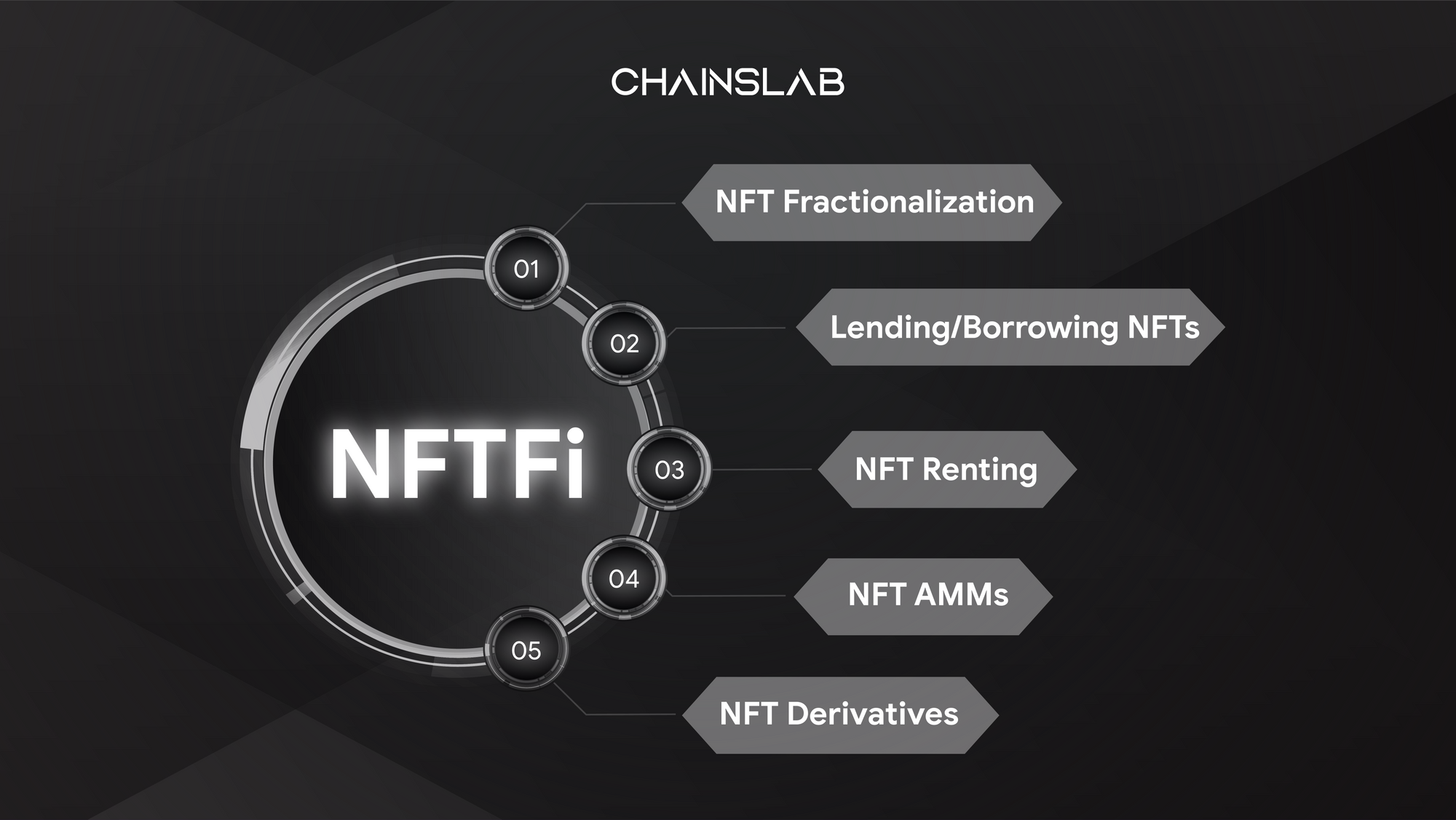

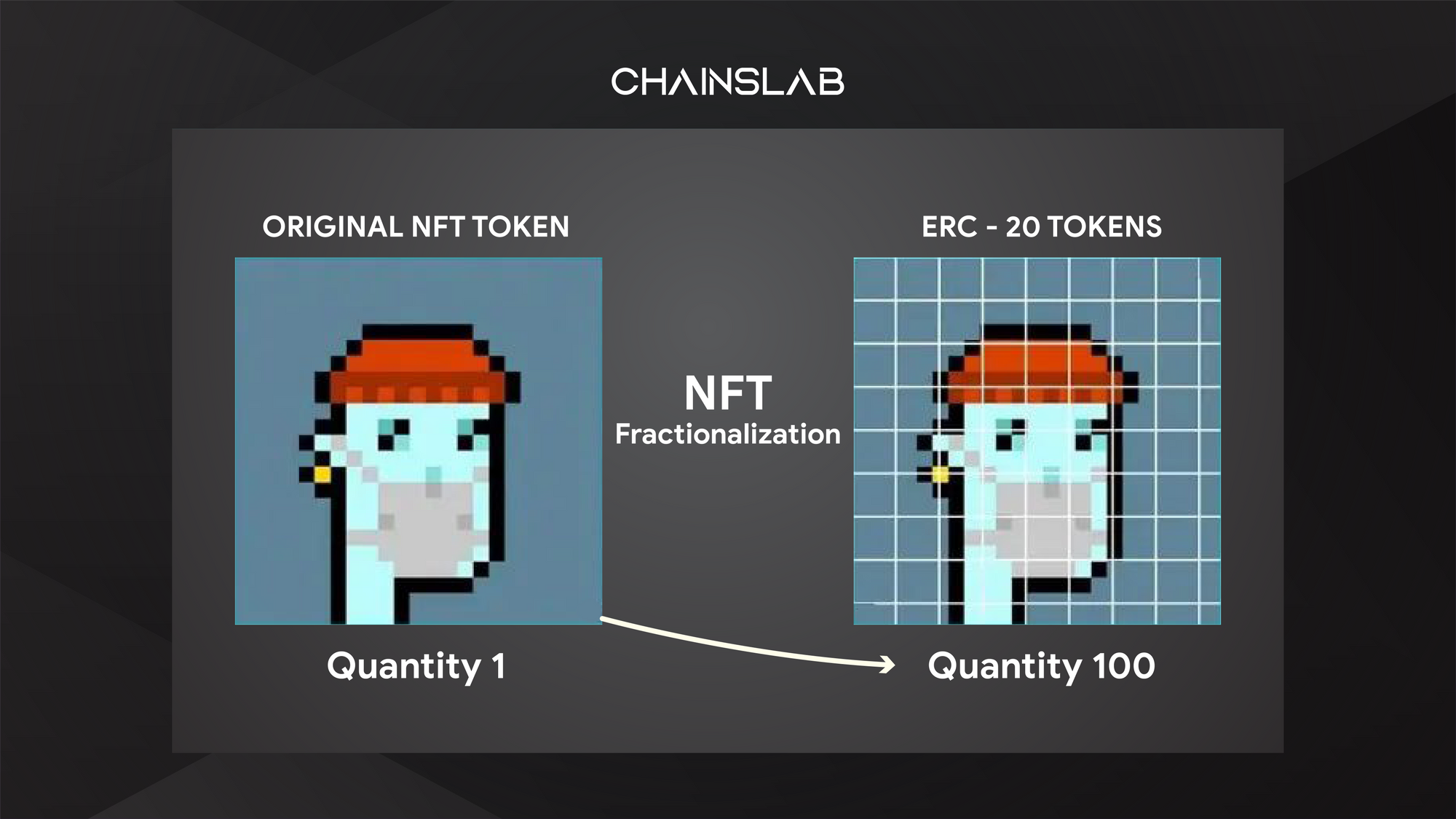

NFT Fractionalization

In reality, the combination of DeFi and NFTs is attracting growing interest and development efforts. Overall, it seems that some projects focus more on adapting NFTs to fit DeFi practices, such as the creation of liquidity pools and fractionalization protocols, which allow NFT holders to easily convert their holdings into cash, and provide smaller/retail investors the chance to invest in valuable tokens. Conversely, other initiatives concentrate on improving DeFi building blocks by utilizing NFT-based assets.

The concept of NFT fractionalization is similar to the idea of fractional ownership in traditional finance, where investors can buy a portion of a stock or other investment rather than having to purchase the entire asset. This provides a way for investors to gain exposure to a high-value asset without having to put up a large amount of capital unfront. NFT fractionalization has a great potential to increase the liquidity and accessibility of the NFT market.

Notable projects: NFTX, Tessera.

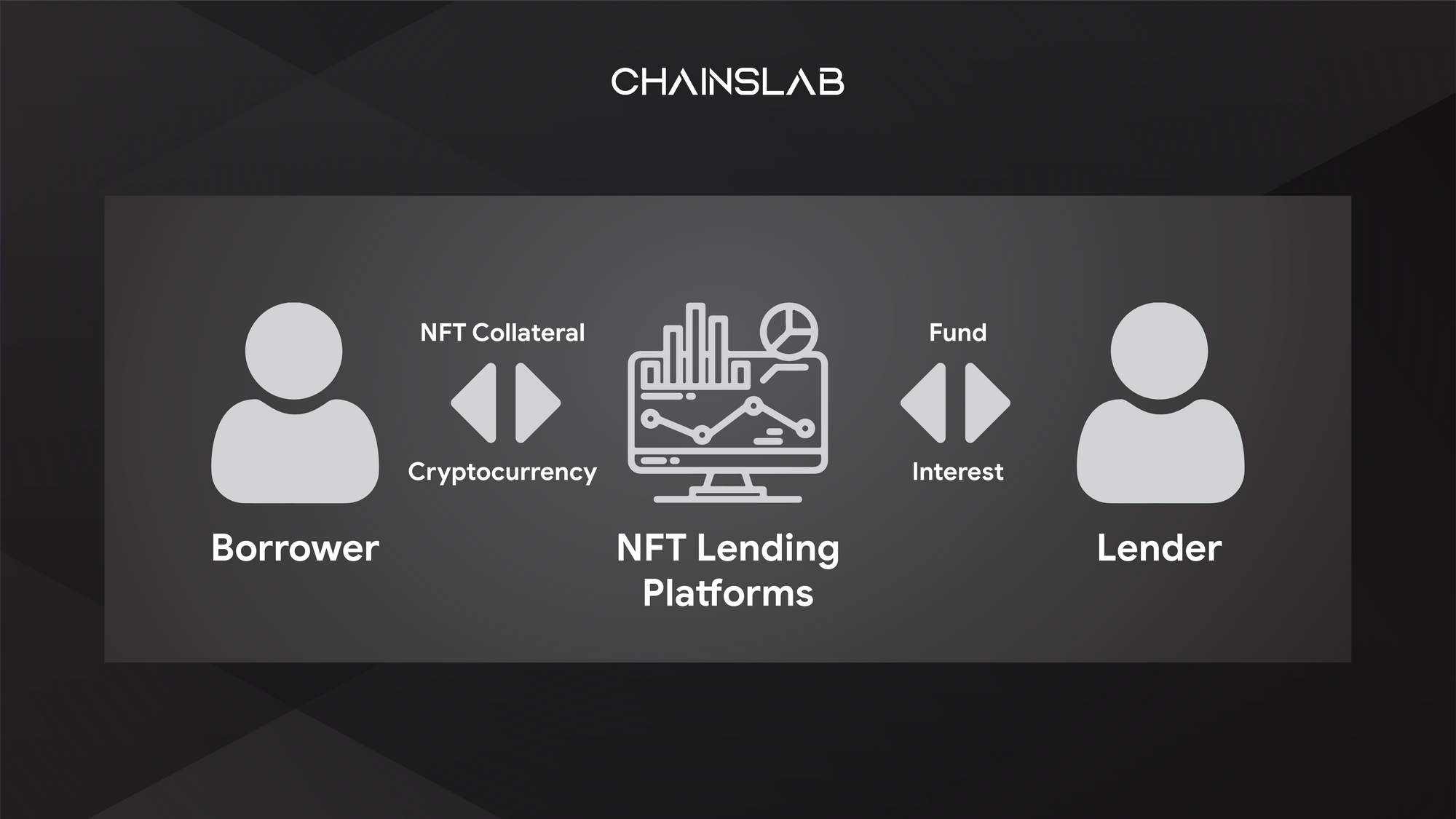

Lending/Borrowing NFT

Lending and borrowing using NFTs is a new development in the DeFi space. NFTs are unique, digitally-signed assets that exist on blockchain networks and are now being used to facilitate lending and borrowing transactions in a decentralized and trustless manner. The use of NFTs for lending and borrowing offers several benefits over traditional methods, including increased security and transparency, accessibility, and liquidity. NFTs can be used as collateral for loans, allowing borrowers to secure funding when traditional methods are not available, while also providing new investment opportunities for lenders.

Smart contracts are used by NFT-based lending and borrowing protocols to manage the terms and conditions of the loan, including interest rates, repayment schedules, and collateral requirements. This allows for a fully automated lending and borrowing process, with no need for intermediaries. The use of NFTs for lending and borrowing provides a new way for NFT owners to monetize their assets, as they can use their NFTs as collateral to secure a loan. This can be used for various purposes, such as purchasing additional NFTs or financing new projects.

The potential benefits of NFT-based lending and borrowing, including increased liquidity, accessibility, and monetization opportunities, are likely to drive further growth and innovation in the DeFi space. However, as with any investment, it's important to carefully evaluate the risks and benefits before participating in NFT-based lending and borrowing.

Notable projects: JPEG’d, BendDAO.

NFT Renting

NFT renting refers to the process of temporarily transferring the ownership rights of an NFT to another party for a set period of time in exchange for a fee. This allows NFT owners to generate revenue from their holdings without having to sell them permanently, while also providing users who may not have the funds to purchase NFTs with the opportunity to use and enjoy their benefits.

NFT renting can also provide a new avenue for NFT creators to monetize their work, as they can lease out their creations for a set period of time, generating revenue from their work without having to sell it permanently.

Notable projects: IQ Protocol, reNFT.

NFT AMMs

NFT AMMs provide a decentralized and trustless platform for the buying and selling of NFTs, by automatically determining the price of NFTs based on the supply and demand in the market. This allows NFT traders to buy and sell NFTs quickly and easily, without having to go through a centralized exchange or an intermediary.

The use of AMMs for NFT trading offers several benefits over traditional methods, including increased accessibility, liquidity, and transparency. AMMs can be used to create liquidity pools for NFTs, which allow NFT holders to easily buy and sell their assets. This helps to increase the overall liquidity of the NFT market, making it easier for NFT holders to monetize their holdings. The use of AMMs for NFT trading is also helping to drive innovation in the DeFi space, as new protocols and applications are developed to take advantage of this technology.

Notable project: SudoSwap.

NFT Derivatives Trading

Every asset has its ups and downs, and so do NFTs, or digital collectibles. However, the market has yet to meet the demand for that extremely large derivatives trading market. Derivatives trading allow traders to take long/short, call/put option a specific commodity asset or security,

Moreover, traders can trade with up to 5x leverage. Perpetual futures contracts do not require real NFTs as collateral. Instead, they track the floor price of the underlying NFT collection. This allows traders to enter and exit the exchange using ETH without the need to provide NFT collateral.

Notable project: nftperp.

IV. Conclusion

Personal thoughts, while many NFT projects are still struggling to find a product-market fit, the author has no doubt that certain projects will far supersede expectations. Yes, a majority of them will probably fail and disappear into oblivion, that’s to be expected from a nascent industry. Volatility and speculation are the natural byproducts. Early movers have an advantage, as meaningful communities will only emerge around a limited number of PFP projects. Therefore, up-and-coming projects will have to innovate and bring something new to the table. As seen historically, sooner or later, another narrative will pick steam, and capital will start flowing as a result. Rinse and repeat?

So, while NFTs can exist and thrive without DeFi, the integration of DeFi into the NFT ecosystem can provide many benefits and help to drive the growth of both industries. However, it's worth noting that the NFT and DeFi spaces are still relatively new and evolving, so it's difficult to predict the future and whether NFTs will indeed require DeFi to grow.

NFTFi is emerging as one of the most exciting newer innovations within Web3. This industry solves the liquidity problem that NFTs face by opening up them to a wide variety of new financial use cases which are currently enjoyed by other asset classes.