The Context

Since the beginning of June 2023, a new trend has been slowly spreading among the crypto community. What initially began as casual conversations among crypto enthusiasts within the Telegram app has since gathered momentum, evolving into a full-blown sensation that, by the time July rolled around, had given rise to an entirely new narrative. Welcome to the era of the Telegram Trading Bot.

After the launch of Unibot and Maestro, the trend of trading bots on the Telegram platform has grown rapidly. The emergence of messaging-based trading interfaces represents a transformative trend that has the potential to redefine the user experience in the digital asset space.

Traditional methods involving wallets and decentralized exchanges (DEXs) often come with their fair share of complexities and inconveniences. However, the advent of products such as Unibot and Maestro, both of which are Telegram-based trading interfaces, has ushered in a new era of cryptocurrency trading characterized by blazing-fast transactions and a comprehensive suite of features.

From the ability to set limit orders to the agility to snipe token launches, these interfaces empower users with tools to safeguard against rug pulls and sandwich attacks, offering a user-friendly alternative to the previously daunting crypto landscape. They play a pivotal role in simplifying the onboarding process for newcomers, broadening the adoption of cryptocurrencies across the globe.

What are Telegram Trading Bots?

The concept of trading bots is not new, but their integration into popular messaging apps like Telegram has been a game-changer. Telegram bots are automated scripts that respond to specific commands or trigger keywords sent by users in a Telegram chat.

A Telegram trading bot is a type of bot designed to execute trades at lightning-fast speeds. These bots are programmed to act swiftly on trading opportunities, often faster than a human trader could. They might not have the best interface, they are filling the gap that is sorely lacking at the moment: fast, efficient trading on your mobile device. They also use Uniswap on the backend to execute trades, meaning that the world is your oyster when it comes to which coins to trade.

The Telegram trading bot trend was initiated by Maestro Bots, which attempted to integrate a bot trading system into the Telegram messaging app. However, Maestro didn't gain significant attention from the crypto community. The trend truly took off when Unibot entered the scene, building upon Maestro's system and introducing additional features, along with a unique revenue-sharing scheme.

Why are Telegram Bots so Popular?

Three key factors have contributed to the widespread adoption of Telegram trading bots:

- Telegram's Massive User Base: Telegram boasts 800 million users as of March 2023, making it a popular platform for crypto enthusiasts and trading communities. The open-source nature of Telegram allows various trader groups to integrate crypto asset price alerts and scam-checking tools, further facilitating the rise of trading bots.

- Simplified Trading Experience: Trading bots on Telegram offer a more straightforward and user-friendly trading experience compared to complex DEX platforms and MetaMask. With just one click, users can purchase cryptocurrencies without multiple signing processes and the lengthy user experience of platforms like UniSwap.

- Additional Benefits: Many trading bot protocols offer additional incentives to users, such as revenue-sharing schemes, transaction fee discounts, and potential speculative gains from associated tokens. These protocols provide users with a quick and efficient trading tool while offering additional benefits.

How it works?

At their core, Telegram trading bots are applications within the Telegram app that users can instruct to execute cryptocurrency trades effortlessly. These bots are capable of buying, selling, copying trades, and even placing limit orders, simplifying the trading process for users.

When using trading bots, users still purchase assets through decentralized exchanges (DEXs) such as UniSwap due to their high liquidity. However, trading bots on Telegram streamline the user interface and experience of Web3 wallets like MetaMask and DEXs like UniSwap. This simplification allows users to buy assets with just a couple of clicks, eliminating the complexities associated with decentralized asset acquisition.

Each trading bot has its own look and feel but they all serve the same purpose: to make your trading experience easier. The main function of most telegram bots is as a protocol for sniping or buying tokens instantly to give you an edge over other traders.

To begin trading with a Telegram bot, users typically create a new wallet address specifically for Telegram, although they can replace it with their MetaMask address. However, for security purposes, it's recommended to keep the trading bot account separate from the primary account.

Here's a simplified overview of how Telegram trading bots work:

- Wallet Setup: Users start by setting up a new wallet address within the trading bot interface. While it's possible to replace this address with an existing MetaMask address, it's advisable to keep trading bot funds separate for security reasons.

- Funding the Wallet: After setting up the wallet, users fund it with cryptocurrency, usually Ethereum (ETH).

- Initiating Trades: Users can then instruct the bot to execute various trading actions, including buying tokens. To do this, they provide the contract address of the desired token. It's crucial to ensure the contract address is copied from an official source to avoid phishing links.

- Transaction Processing: The trading bot processes the transaction, considering gas fees, and executes the trade with just a couple of clicks. This streamlined process distinguishes Telegram trading bots from traditional DEXs.

What’s the catch?

Nothing in the crypto world comes without its own inherent risks and trading bots are no different.

Whilst speed and convenience are the strength of Telegram bots, security is the main weakness and trade off.

It's essential to exercise caution when dealing with trading bots. Only integrate bots from trustworthy sources with reputable teams to avoid potential risks like malware and data harvesting.

Another concern is that trading bots require you to connect your wallet for trade execution based on your settings. While these bots claim to erase wallet access after use, trust remains a concern unless you're a coding expert who has reviewed the source code personally.

To reduce these risks, consider using a 'burner wallet' for bot trading. This means transferring only the funds you need from a separate wallet. It's a simple precaution, similar to what you should already do when trading on your preferred perp dex.

The Bots Wars

Telegram trading bots, with their accessibility and convenience, have taken the crypto space by storm and recently emerged as a new narrative in the cryptocurrency space.

While different bots have slightly differing functions, most bots generally execute the same basic trades. These include a variety of features – stop loss and take profit orders, anti-rug and honeypot features, copy trading, multi-wallet, liquidity, and method sniping features.

Let's dive into some of the names that are competing in this “Bot Wars”.

Unibot

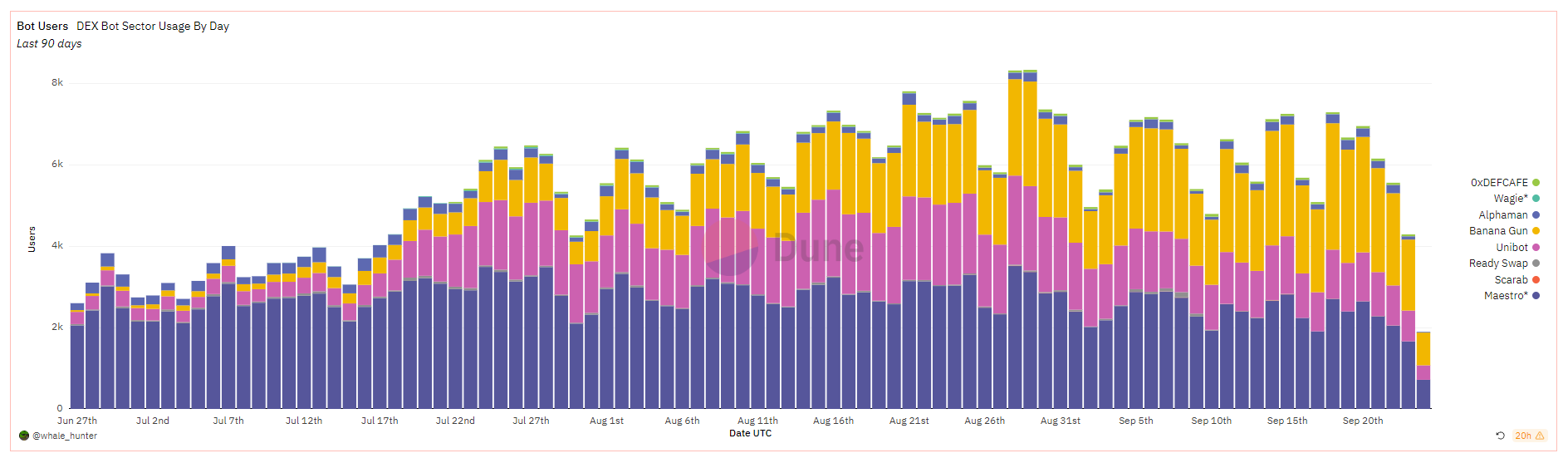

Leading the pack, Unibot pioneered the Telegram trading bot trend, enabling users to trade on the Ethereum network. Notably, Unibot boasts the highest market capitalization in the trading bot arena, reaching a staggering $132 million. This remarkable valuation can be attributed to Unibot's deliberately limited token supply, with just 1 million UNIBOT tokens in circulation. As of August 2, 2023, the price of 1 UNIBOT token stands impressively high at $127, and within a mere two months, it has surged by over 1000%.

Unibot's arsenal of features includes DEX sniping, mirror sniping for copy trading, in-depth profit-loss analysis, private swap capabilities, limit orders, and robust MEV protection mechanisms. The graph below illustrates the steady growth in Unibot's user base, firmly establishing it as the most popular trading bot to date. Furthermore, Unibot has ambitious plans for Unibot X, a suite of premium tools tailored for seasoned traders. Currently in the testing phase, Unibot X's early trials are accessible to the platform's most active users.

Unibot takes care of its token holders through a lucrative revenue-sharing program. Owners of UNIBOT tokens enjoy a 40% share of transaction fees and a 20% allocation of token taxes. Additionally, token holders benefit from reduced protocol transaction fees when holding a minimum of 50 UNIBOT tokens and referring others to the platform.

Unibot's dominance stems not only from its advanced trading capabilities but also its user-friendly interface. The Unibot team consistently rolls out various features and updates, ensuring a cutting-edge trading experience for its ever-growing user base.

Maestro Bots

Maestro Bots is the first trading bot protocol, enabling users to trade across Ethereum, Binance Chain, and Arbitrum networks. Remarkably, Maestro has yet to introduce its own token or announce plans to do so. This distinction played a role in Unibot's success, despite Maestro's earlier launch.

Instead of creating tokens, Maestro offers a subscription model, priced at $200 per month. Subscribers gain access to premium features like accelerated bot transaction processing, ten Telegram wallet addresses, ten 'god mode snipes,' and more. Additionally, Maestro applies a modest 1% transaction fee.

What sets Maestro apart are its additional functionalities that Unibot lacks. These include a bot for securing presale tokens of upcoming projects, 'god mode snipe' for faster and safer transactions, avoiding MEV and sandwich attacks, and a whale tracker.

Wagiebot

Following in the footsteps of Unibot, Wagiebot quickly rose to prominence in the trading bot landscape. Yet, what sets Wagiebot apart are the diverse features it brings to the table, some of which Unibot doesn't offer. Renowned for its lightning-fast performance, Wagiebot operates its own private nodes on Ethereum, BNB Chain, and Arbitrum networks. In July, WAGIEBOT skyrocketed by an astonishing 6,762%. However, it's essential to note that the current price of WAGIEBOT stands at $0.3, reflecting a 70% decrease in the past week.

Wagiebot's Telegram trading bot is packed with features that closely mirror those of Unibot and Maestro. It provides multi-wallet functionality, sniping capabilities, MEV-resistant order execution, and even supports Dollar-Cost Averaging (DCA) strategies. Additionally, Wagiebot seamlessly integrates with the GMX trading platform, allowing users to engage in perpetual trading directly on the Telegram app. Looking ahead, Wagiebot has ambitious plans to extend its reach to Discord, with the intention of adding new features to its Telegram platform first.

The WAGIEBOT token primarily serves to offer users reduced transaction fees within the Wagiebot ecosystem. This discount system operates on tiers, meaning that the more WAGIEBOT tokens you possess, the greater the discount you receive. Additionally, owning more tokens enables users to execute a higher number of simultaneous trades and manage more wallets.

Wagiebot's technological prowess and advanced features give it a distinct edge over Unibot. However, it's essential to remember that the popularity of a crypto protocol is influenced by factors beyond just technology.

Banana Gun Bot

The Banana Gun Bot categorizes its services into two different tiers – Tier 1 and 2. Their Tier 1 services have more limited services like manual buying, charges 0.5%. On the other hand, their Tier 2 services charge 1% but include more advanced features like auto sniping.

The Banana bot currently supports many different features, like generating wallets, anti-blacklist, and more. The Banana bot team is still working on more features and has released a roadmap for their future plans. On 1 August, the team recently released a new feature – a Telegram scraping bot that allows users to automatically buy any coins posted in a channel of their choice. In the future, the Banana bot team hopes to build an ecosystem for the bot.

LootBot

LootBot is a Telegram-based bot tailored to assist airdrop farmers in streamlining their airdrop farming endeavors. Whether you're new to airdrop farming or a seasoned pro, LootBot provides a secure and user-friendly solution for discovering, participating in, and monitoring airdrop opportunities across a wide array of upcoming chains and protocols, with support for over 15 chains and counting.

In the crypto landscape, timing is everything, and LootBot aims to simplify the airdrop farming journey, ensuring you never miss out on potential rewards. Launched in July, the LootBot token swiftly climbed the ranks, securing its position as the third-largest in market capitalization among Telegram Bot tokens, as reported by CoinGecko. This success underscores the growing significance of LootBot in the crypto community, particularly among airdrop enthusiasts seeking to maximize their gains.

The Conclusion

In conclusion, the Crypto market is experiencing a surge in the development of tools and services to enhance trading experiences. These tools come with an array of features and functionalities, encompassing advanced coin filtration, token sniping capabilities, comprehensive position management, influencer tracking, and the invaluable insights derived from social analytics. Through the strategic utilization of these tools, traders are empowered to gain a competitive advantage, save precious time, and make more well-informed investment decisions.

In this landscape, one standout example is Unibot, a Telegram-based trading bot that initially flew under the radar but has since surged in popularity. Its ascent can be attributed to a trifecta of factors: the widespread adoption of Telegram as a messaging platform, the intuitive nature of trading bots compared to other trading interfaces, and the enticing profitability they offer. Despite the security considerations that accompany their use, these Telegram-based trading bots are poised to usher in a revolution in the way we engage in cryptocurrency transactions.

In this rapidly evolving arena of cryptocurrency trading, it's clear that each of these Telegram bots brings its unique strengths and functionalities to the table, catering to a diverse range of trading needs and user preferences. Whether you prioritize sniping new tokens, implementing MEV protection, executing limit orders, or exploring novel strategies, these bots have you covered.

What's particularly exciting is that Telegram trading bots are still in the early stages of development within the cryptocurrency landscape. With the pace of innovation and the ever-expanding crypto ecosystem, we can anticipate even more enhancements and features on the horizon. As the crypto trading landscape continues to evolve, these bots will undoubtedly play an integral role, reshaping the way traders navigate this dynamic market. Stay tuned for what the future holds as this fascinating bot war unfolds.