The crypto markets have survived some of the roughest economic conditions in a generation, with a global pandemic and record inflation crammed into three years. However, while 2021 saw new all-time highs for cryptocurrencies, as of late 2022, Bitcoin and the broader cryptocurrency market have been hammered. While these tokens are attempting to recover their value, investors at the end of year were still waiting to see if Bitcoin and other tokens could come back.

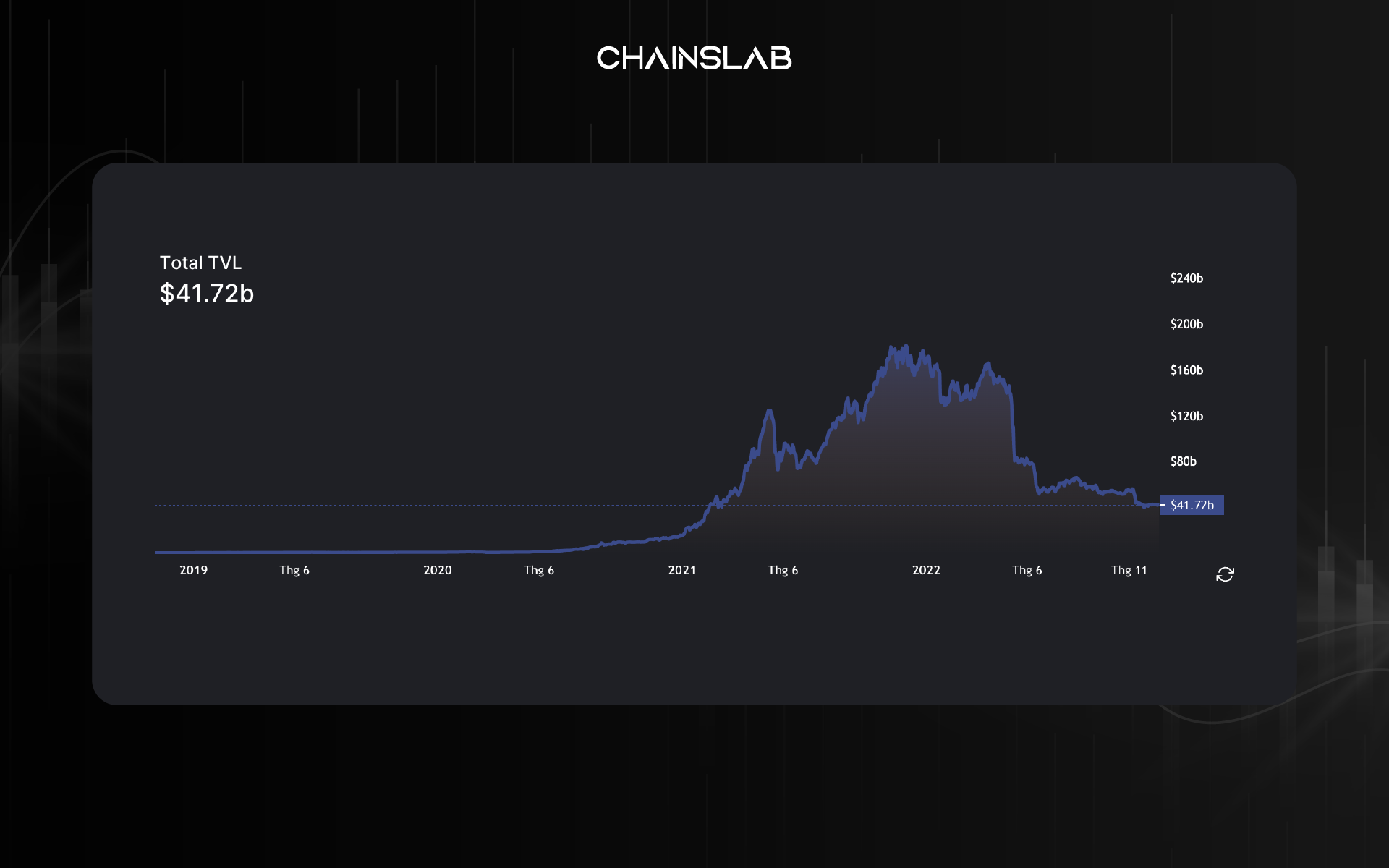

As a result, despite the growing adoption surrounding decentralized finance (DeFi), the DeFi industry has come under intense pressure in the past few months due to the slumping of the TVL from $250 billion to over $40 billion. Hence, market conditions and a lousy overall performance in 2021 were causing people to question if DeFi is dead. The following article will explore the health of the DeFi sector and see what's in store next for this new financial movement.

I. DeFi and Its Problems

While DeFi adoption saw a significant initial spike, with users drawn to blockchain-based financial products and services, it comes with its problems. The first and most prominent one is high transaction costs. Most DeFi projects are based on the Ethereum blockchain. The implication of this is a significant increase in transaction fees due to congestion on the network, with users trying to access the different DeFi applications on the platform.

However, as the development of many layer 2 scaling solutions - Arbitrum and Optimism, zkSync that have been and are about to launch to remove that of Ethereum's drawbacks. In addition, Ethereum’s roadmap itself has also had upgrades that bring mass adoption closer and closer.

Furthermore, the DeFi ecosystem also has a liquidity hurdle, leading to an inefficient market. DeFi has adopted several models to address the liquidity issue, such as liquidity pools incentivizing users to deposit their assets and earn rewards.

In turn, this approach has limitations, is risky, and is dependent on token holders who may or may not act in the best interest of the protocol. As evidenced in the graphic above, almost all DeFi is extremely unprofitable. This is not because there isn’t sufficient revenue generation. DeFi protocols generate relatively large revenue. For example, AAVE generated $101.4 million in revenue annually. But the problem may appear to start with 90% of its revenue being distributed to lenders, leaving the protocol margin at around 10% (10.92 million). This isn’t the core issue. There are still millions of dollars in revenue for the protocol itself. The problem lies squarely in liquidity mining’s hands. AAVE paid out $74 million in incentives to rent liquidity, creating a net loss of $63.96 million for one of the largest protocols in DeFi.

However, glaringly standing alone in profitability is Maker. Generating $28.61M in total revenue, which was all accrued to the DAO. This is due to there being no reward token with dividend payouts. This proves not every protocol needs a token. Many DeFi aficionados’ palettes are so accustomed to protocols treating emissions like Jerome Powell with a magical money printer that they prefer when protocols instead don’t even offer a token. No reward token, no operating loss, no dilution. But it is undeniable that a carefully gamified and well-balanced token economy can create lightning in a bottle.

It is clear that the business models of many DeFi platforms are indeed at issue. When in TradFi, businesses often pay yield to shareholders through dividends, which are generated from the company's profits. In contrast, during the last DeFi summer, we could see that it was a giant Ponzi scheme. Protocols did not make any profit, at all, or were not enough to pay the parties involved. Instead, they issued more tokens to pay, leading to the economy getting deeper and deeper into a blackhole of inflation. Finally, it turns out Ponzinomic.

Another problem is interoperability. Each blockchain network is different. Each offers different access controls, consensus protocols, designs, and assets definitions. However, these capabilities exist in isolation, making it difficult for users to move value from one blockchain to another.

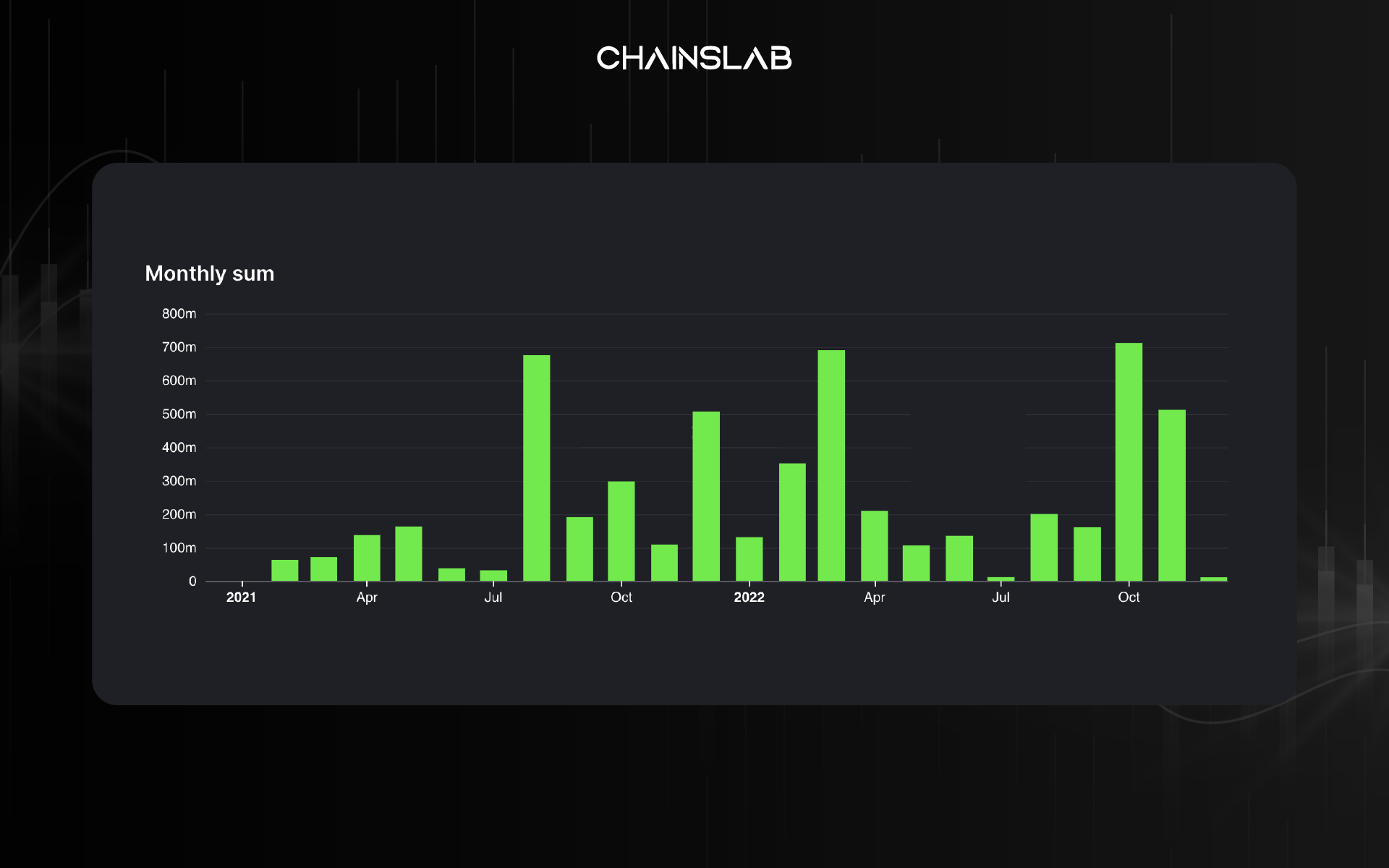

Additionally, the emergence of a variety of scams due to lack of regulations and the collapse of Terra have also left a significant negative impact on the DeFi ecosystem. DeFi has had its fair share of security issues, with numerous hacks that have seen liquidity drained from protocols. According to DeFiLlama, DeFi protocols have lost around $5 billion in total due to scams, hacks, and exploits. Point of decentralization is open source code, this also means that hackers are easily able to find weaknesses and attack, at this time DeFi will always be vulnerable due to it.

II. Winter is Here

The last crypto bear market had its roots in rampant over-speculation. The ICO boom of 2017 eventually led to the ICO bust of 2018, taking vaporware projects down with it.

This cycle has been markedly different. The crypto winter of 2022 did not start with blockchain – the chill blew in from the wider global economy.

It’s no exaggeration to say that the global economy has seen better days. Traditional finance and centralized systems have been rocked by a series of profound shocks, exacerbated by profound political mismanagement.

Despite this, crypto bucked the trend last year, holding out against the macroeconomic headwinds. Eventually, however, the price of bitcoin began to drop from its November 2021 high and the market began its multi-month drawdown, slowly at first and then quickly.

The first major domino to fall was Terra (LUNA) and its dollar-pegged stablecoin UST. Then came Celsius, Babel, CoinLoan, Three Arrows Capital, Voyager, and BlockFi. More recently, Sam Bankman-Fried, FTX, and Alameda joined the list of the fallen, claiming plenty of collateral damage in the process.

In fact, the FTX contagion had already worked its way through the entire crypto ecosystem during the height of the bull run. FTX was merely its apotheosis when the full extent of the cancer was discovered.

III. DeFi is Working Hard

Centralized crypto platforms may be suffering greatly, with a string of collapses this year, but decentralized finance continues to march on. The total value locked in decentralized protocols sits at $41 billion, a considerable fall from peak levels, but still showing remarkable growth from pre-pandemic figures.

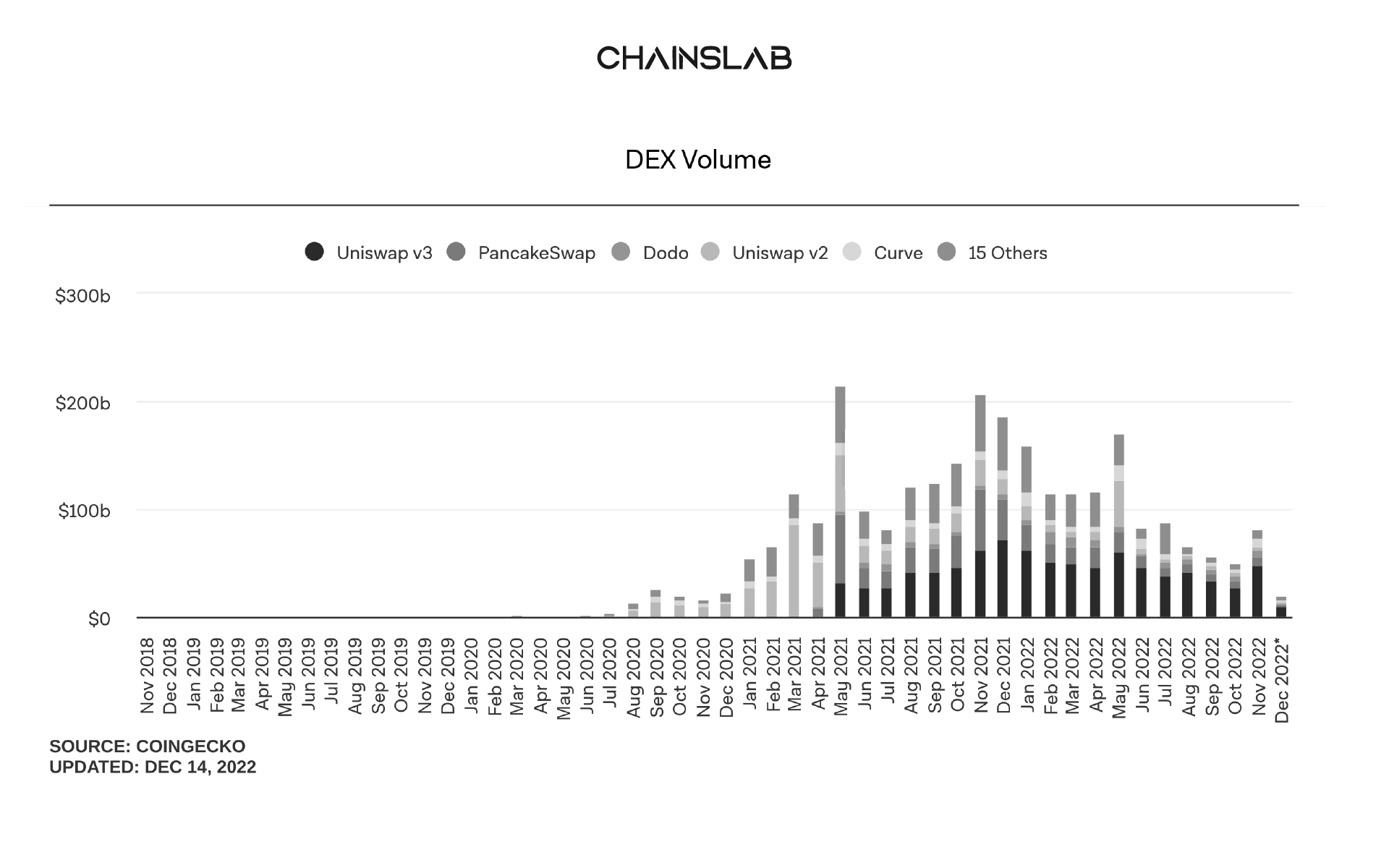

The FTX's contagion woke up DeFi along with its distinctions - non-custody, transparency. The continuing resilience of DeFi represents a success story when compared to the ignominious failure of Centralized crypto. DEX volumes routinely pass $1.5 billion a day while demand for on-chain derivatives is growing, buoyed by FTX’s ungraceful exit. GMX (Arbitrum) and gTrade (Polygon) have joined DeFi derivatives leader dYdX in leading the charge.

Since the start of the year, dYdX has been working towards becoming fully decentralized. Version 4 is earmarked for launch in the second quarter of 2023 and will mark the evolution of the exchange into a wholly decentralized platform. dYdX chain will be built on Tendermint consensus technology and mark the arrival of the exchange on Cosmos. This will allow dYdX to offer customers “a fully decentralized, off-chain, orderbook and matching engine.”

IV. What’s Next for DeFi?

Before the DeFi summer, there were already protocols around. For example, synthetics, MakerDAO, Compound, and Aave. Decentralized finance hasn’t slowed down in innovation, the number of users increased. In the last year, DeFi took a bit of a nosedive, just like the whole crypto industry. There was some adoption; however, there were much fewer users. Crypto was still small, and that makes it hard to measure success. During the DeFi summer, more products arrived. DeFi saw maturation of DeFi as the X-to-earn adaptation.

According to the author's personal assessment, there are many improvements that DeFi needs to improve in the near future. The author specifically wants to refer to the following objects:

- Enterprise DeFi

Enterprise DeFi will legitimize DeFi with real-world investment. Nonetheless, still wonderful new products entered the market. We may see RWAs (real-world assets) entering DeFi in the future.

A concern is regulation. After the LUNA crash, FTX default, we might see more regulation incoming years. That’s a two-edged sword. Regulation can make DeFi no longer DeFi, when there will be settings used to protect investors from fraudulent and unsafe projects. At the same time, investment funds will have the opportunity to directly invest in DeFi projects, from which the market will receive an extremely large amount of liquidity, even larger than the amount of money poured into crypto last bullrun.

A recent study has revealed just how massive this interest is. Specifically, a vast majority of the largest hedge fund executives believe that at least 7.2% of their holdings will be in cryptocurrencies by 2026. This mounting interest has led to the emergence of enterprise DeFi. Be ready!

If DeFi delivers on its promise, we’ll see institutions and everyday users flocking to the DeFi ecosystem, and eventually there will be a full-fledged integration of DeFi into the existing financial infrastructure.

- Progressive Decentralization

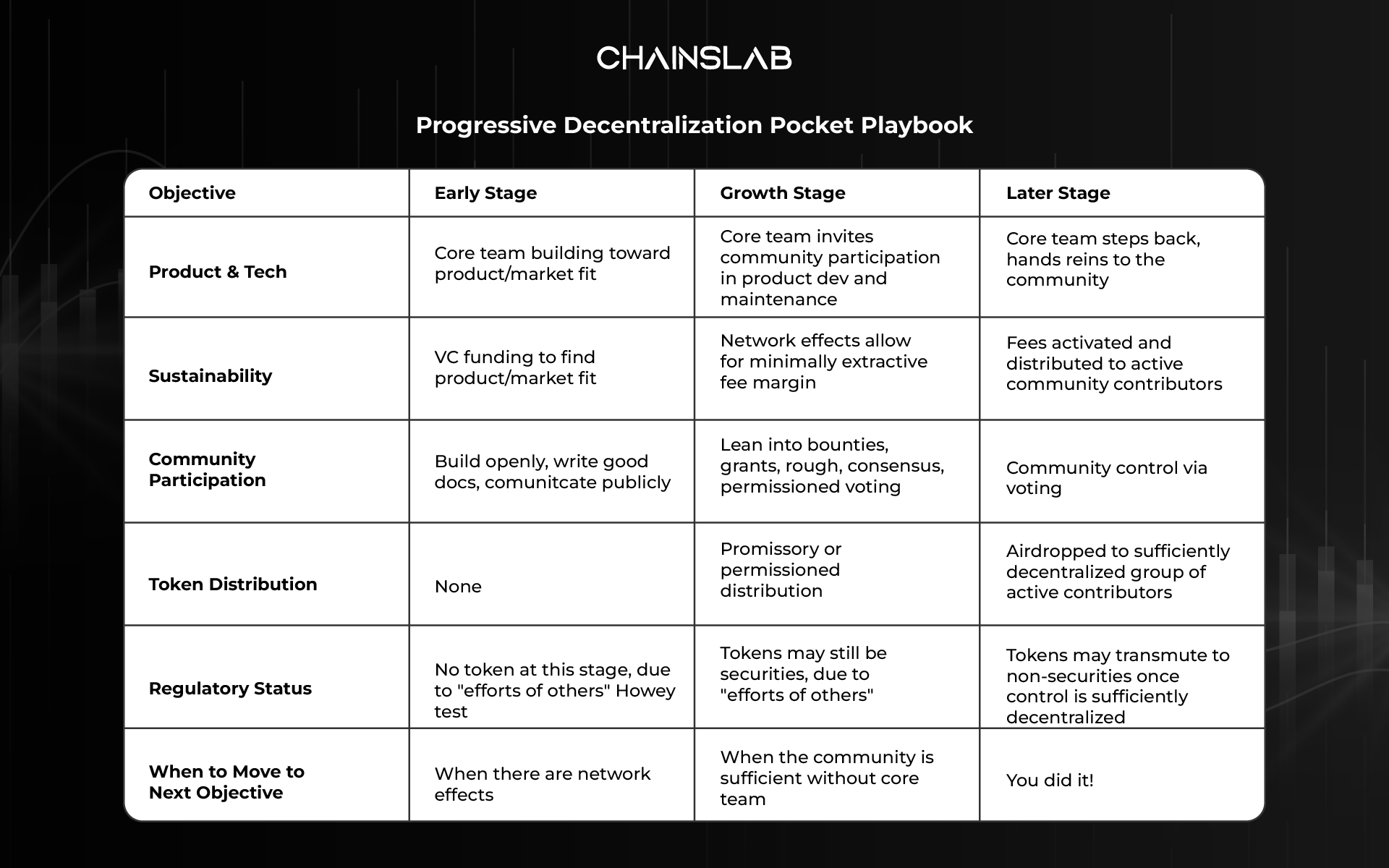

a16z wrote an influential guide on Progressive Decentralization for crypto applications that is still very relevant in 2022 and later. As projects establish product/market fit, financial sustainability, a participatory community and regulatory compliance, they should seek to reduce their single point of failure — centralization.

In addition, the infrastructure for most crypto projects today is being built on the physical basis of the centralized system. Taking ETH into consideration, according to Ethernodes, the platform reveals that AWS makes up for a significant ~67% of ETH 2.0 nodes. This may leave the Ethereum blockchain vulnerable.

- Profitable

As mentioned in the previous section, the current DeFi business model is unsustainable and non-profitable. However, the recent concept of DeFi 2.0 with "real-yield" narratives has brought a new breeze in the minds of DeFi founders in the way of building a product.

The probability of a token death spiral due to mercenary capital flows is also reduced. But real yield is not everything. Market participants need to consider other factors such as token use cases, profitability, sustainability of the business model, and proportion of fee distribution.

- Better UI/UX

Even the core beliefs of liberalizing finance, giving the people control of money, a truly transparent system, and giving equal access to everyone are very noble and just core beliefs and things should remain this way. However, the main issue that DeFi is running into is the UI/UX problem.

The people who really understand DeFi and frequently use it know how good it is but in order for the general public to understand it, it can be an extremely complex task. However, everyone is not going to be willing to put in months of work just to understand this space.

V. DeFi is Here to Stay

This crypto winter has its roots in the bad decisions of centralized authorities. Over the past three years, governments and central banks around the world have proven to be spectacularly poor custodians of the financial world. Bad decision after bad decision has crashed economies, destroyed labor markets and instigated runaway inflation that’s devalued fiat currencies and eroded consumer spending power.

Crypto has not been immune from poor centralized planning either. Bad decisions in national government have been compounded by bad actors within the crypto industry itself. Centralized companies including exchanges, lenders, and venture capitalists got greedy.

As time goes by, it becomes increasingly clear that the DeFi sector is not only here to stay, but is set to change the investment landscape for good and for the better. The antidote to this is decentralization. While decentralized platforms are not immune to wider economic forces, they have proven better equipped to handle the very worst of the duress. Decentralization and those who stick with it will eventually emerge from this winter stronger than ever.

For the market insights on DeFi and other technologies, head over to the Chainslab Twitter to keep yourself always updated.